AP 2020 特辑

考试信息

- 考试时间:北京时间5月21日凌晨4点

- 两道FRQ

- Question 1 (55%): 25 minutes + 5 minutes to upload response

- Question 2

- 删减一个单元

Unit 6 Market Failure and the role of Government (8% - 13%) - Q1 = FRQ2 + FRQ3

- Q2 = FRQ1

考点

| Units | Exam Weighting |

|---|---|

| Unit 1: Basic Economic Concepts | 12-15% |

| Unit 2: Supply and Demand | 20-25% |

| Unit 3: Production, Cost, and the Perfect Competition model | 22-25% |

| Unit 4: Imperfect Competition | 15-22% |

| Unit 5: Factor Markets | 10-13% |

考察重点

- Unit1需要明确 definition

- Unit2几乎一定会融合在不同市场形式中考察(Unt3+4+5)

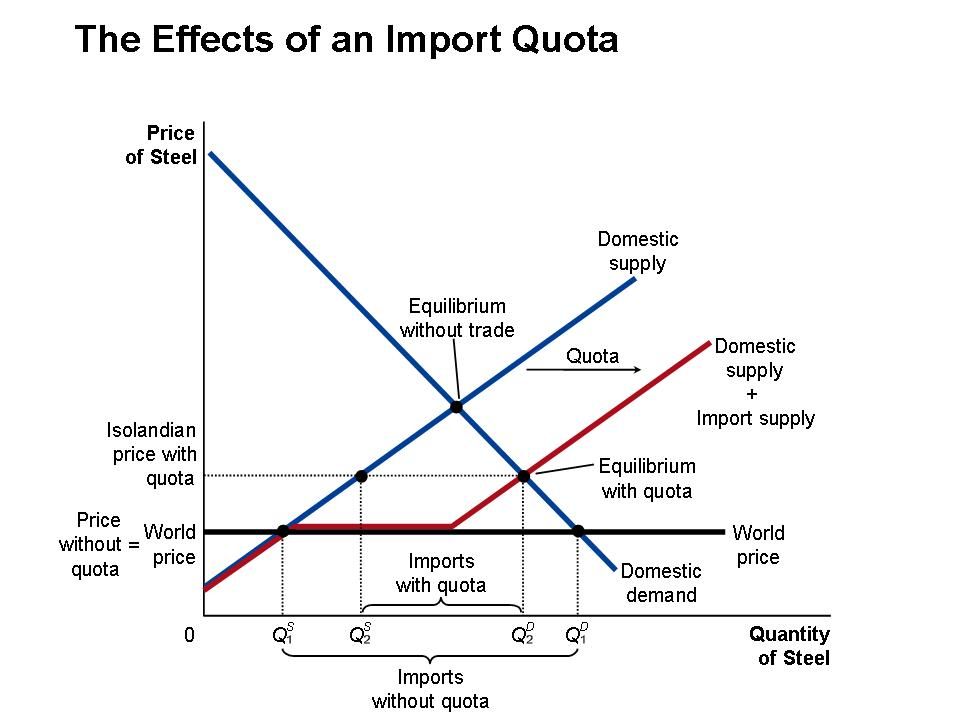

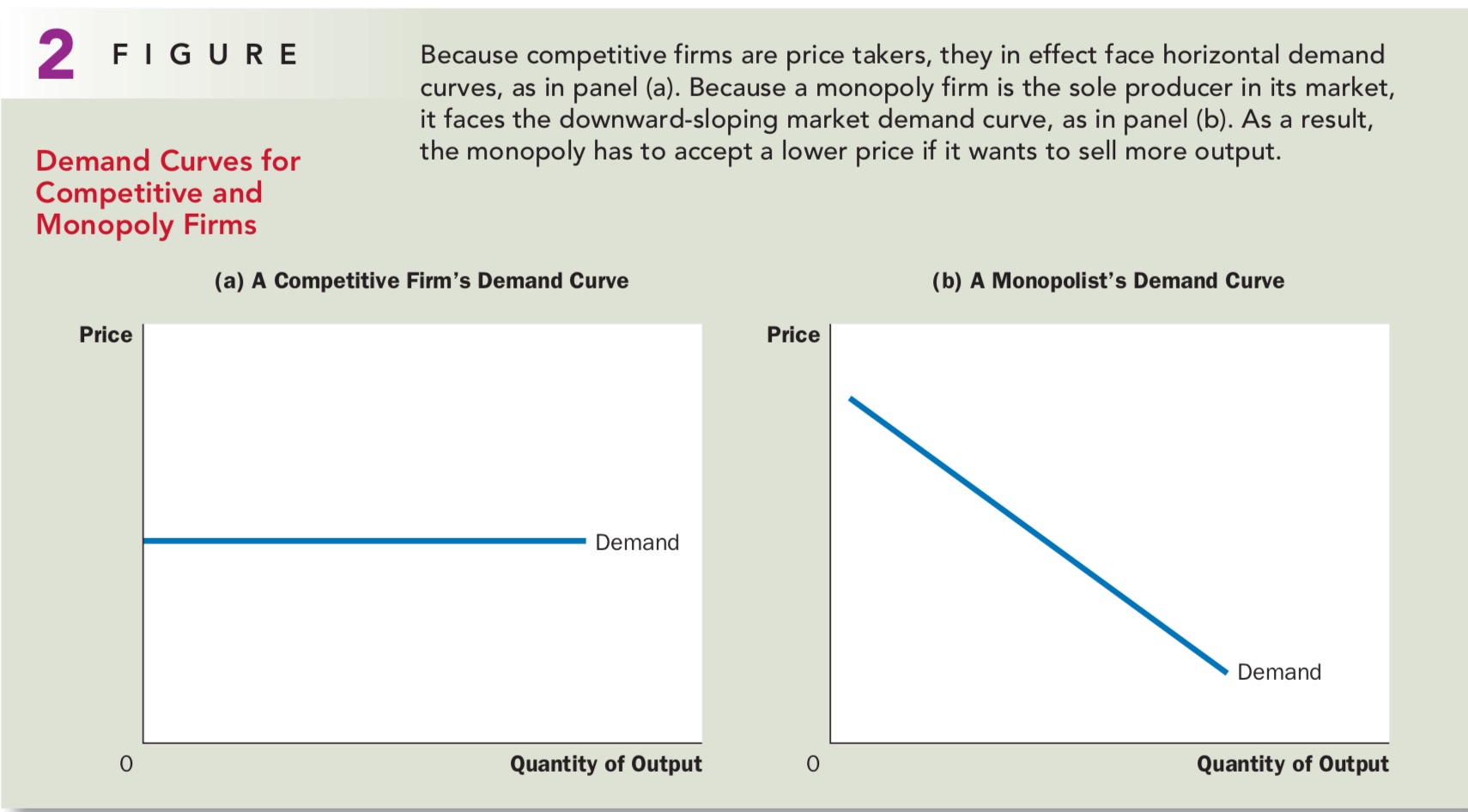

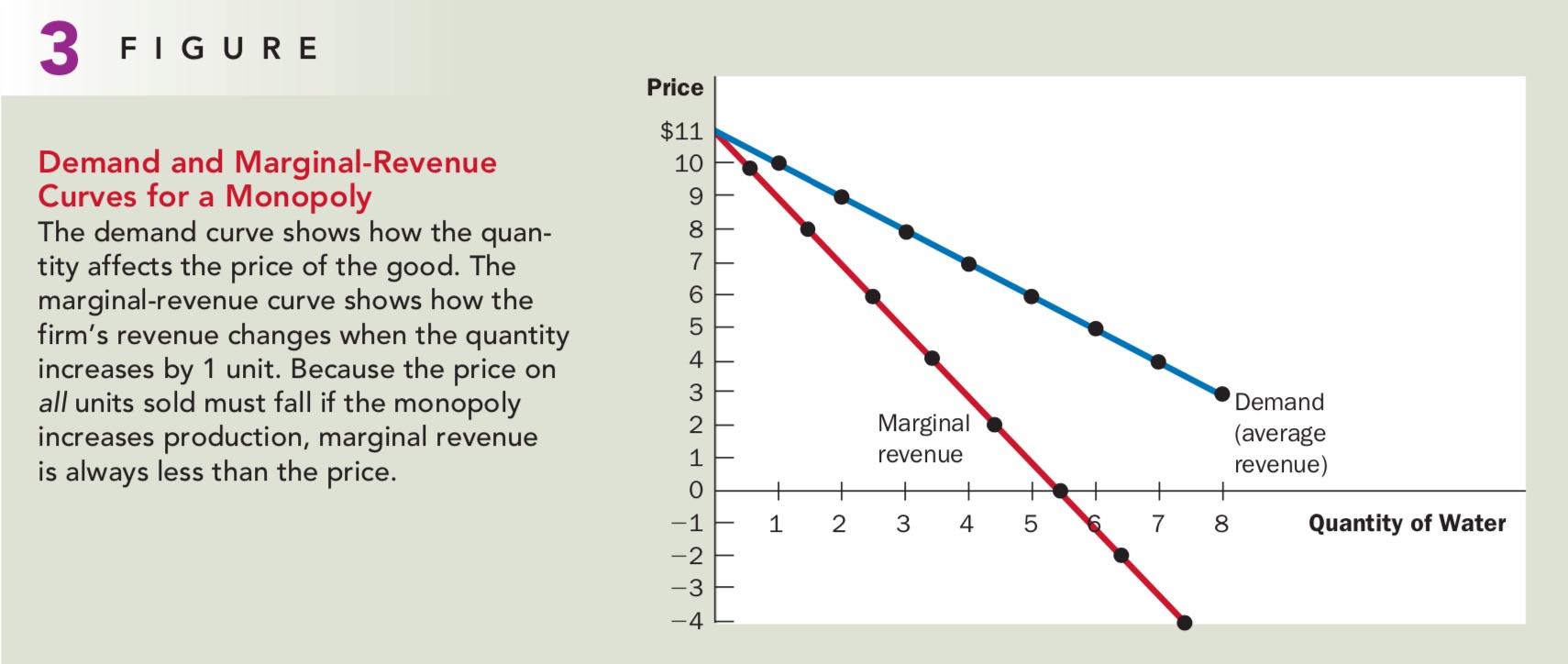

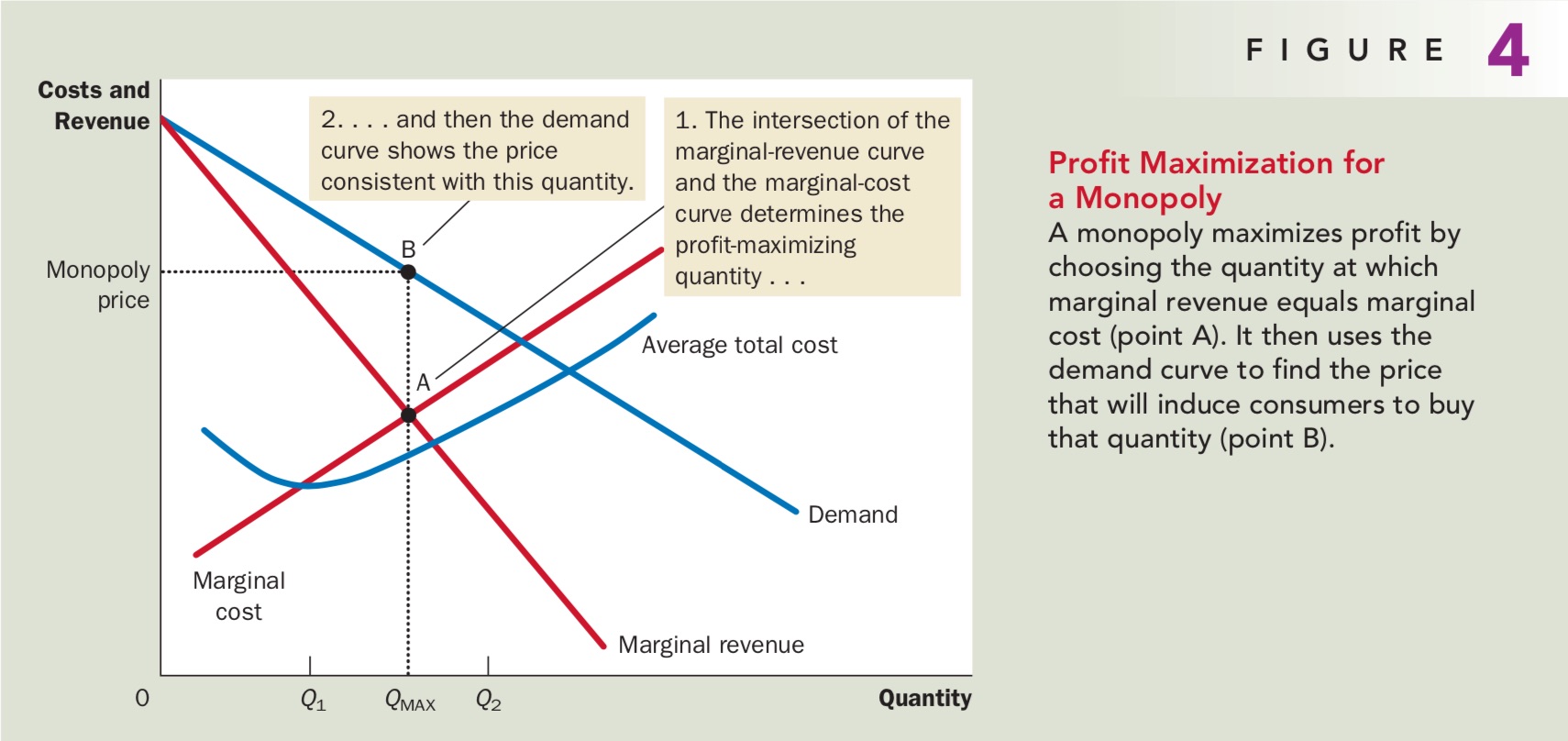

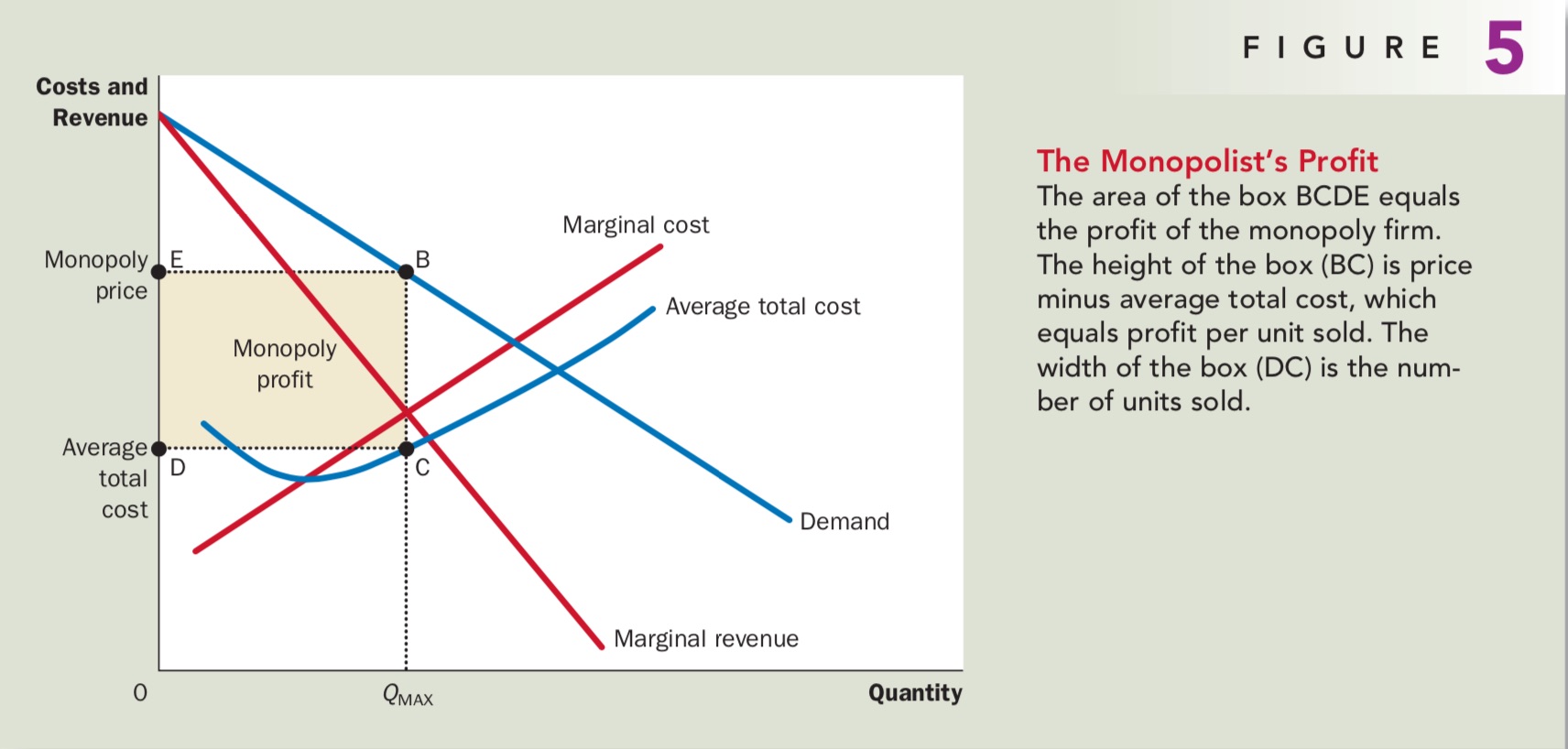

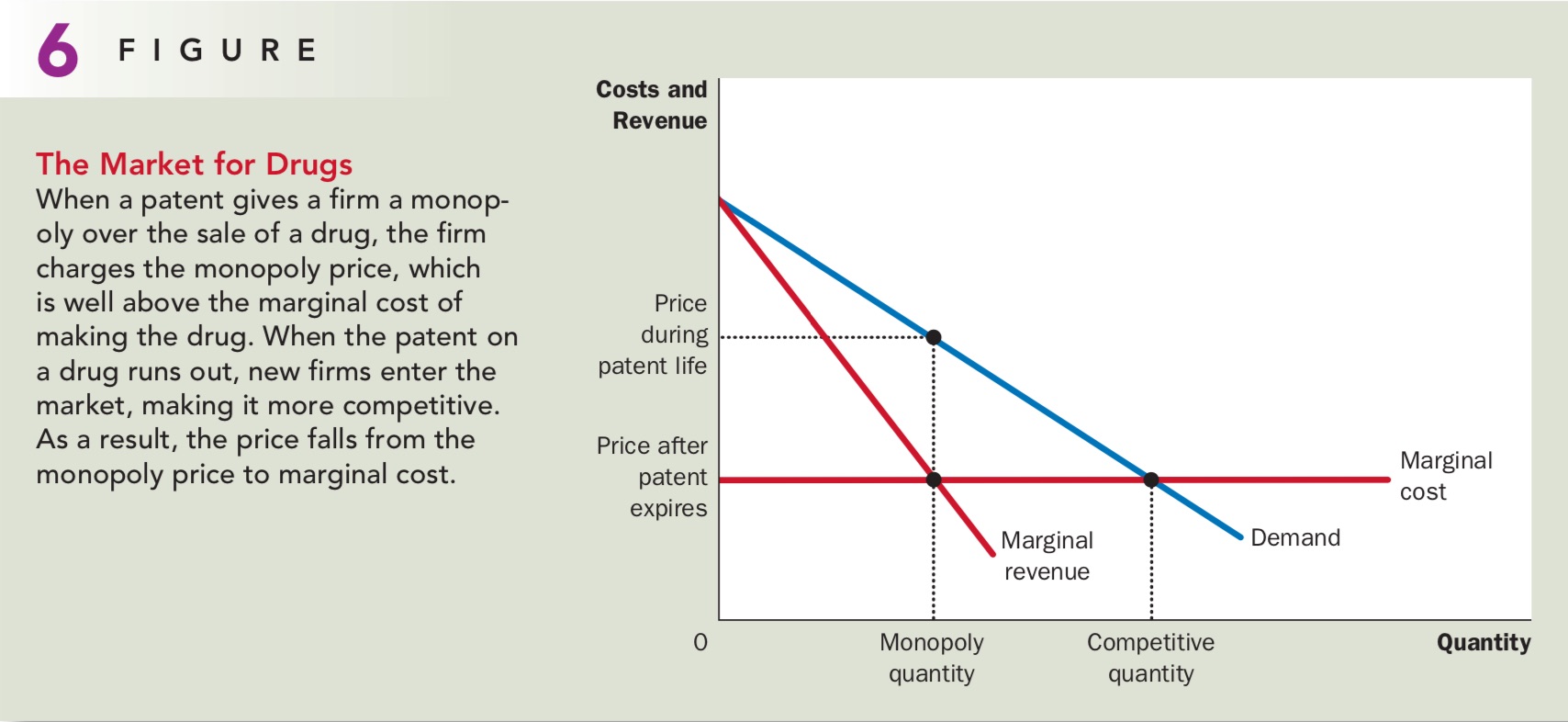

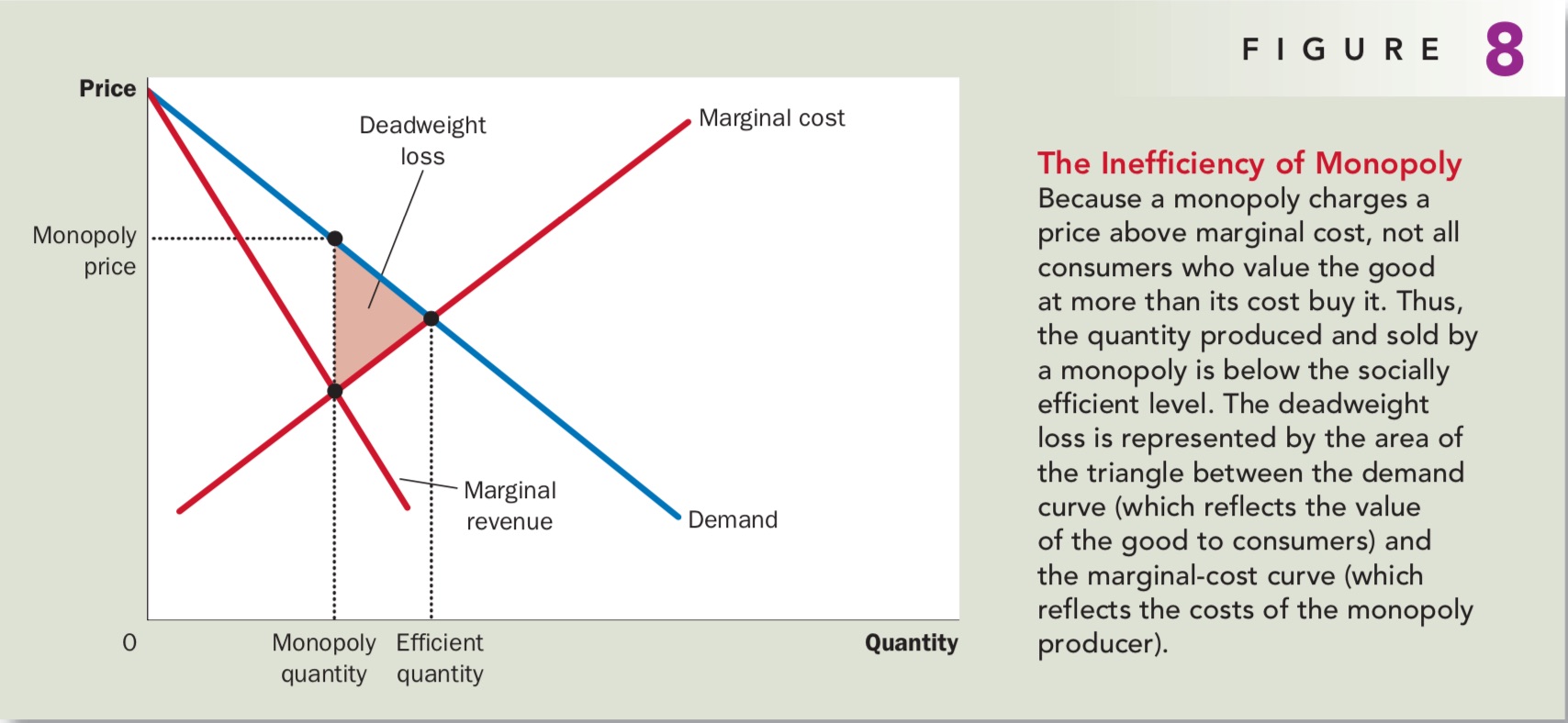

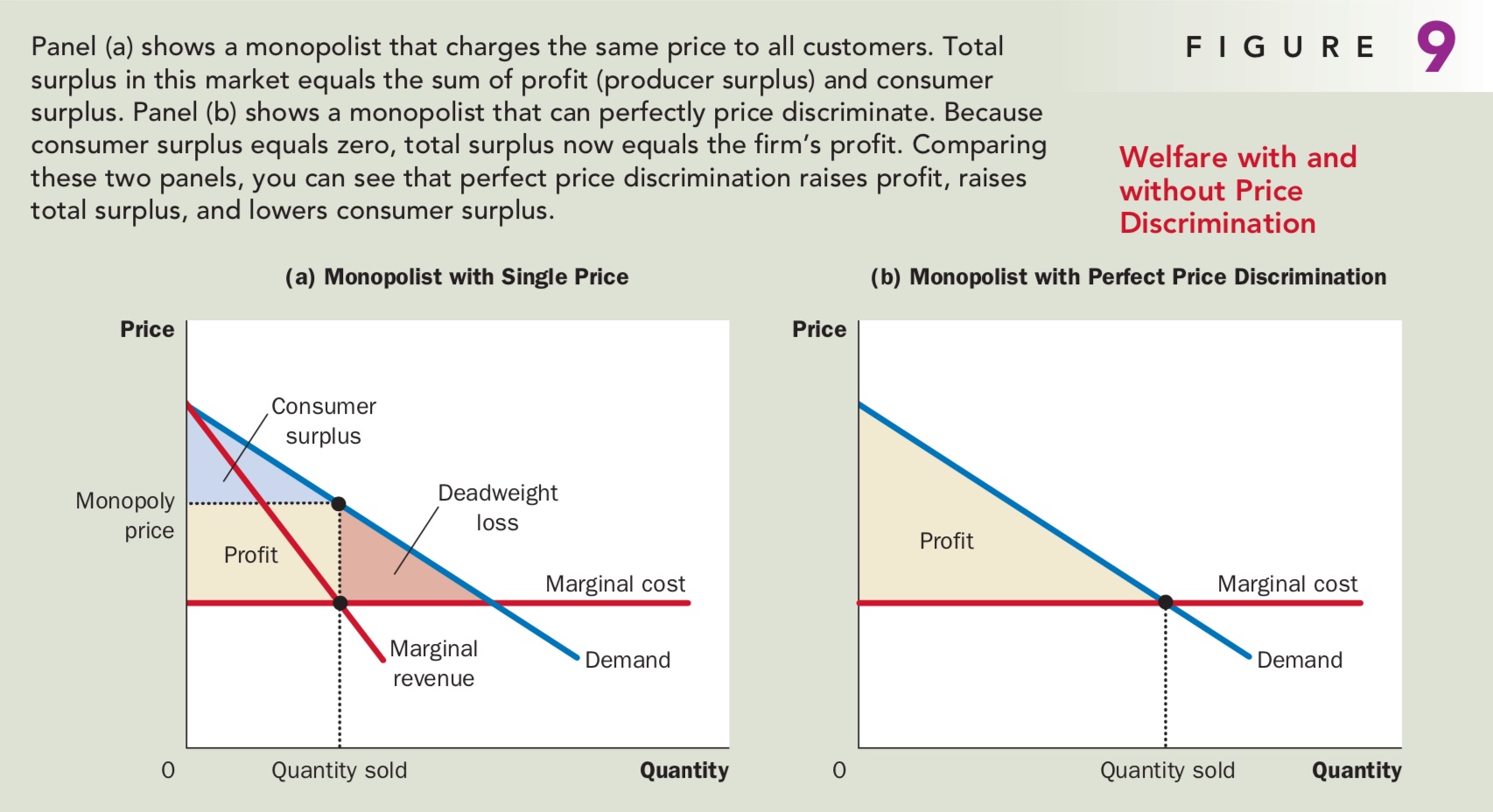

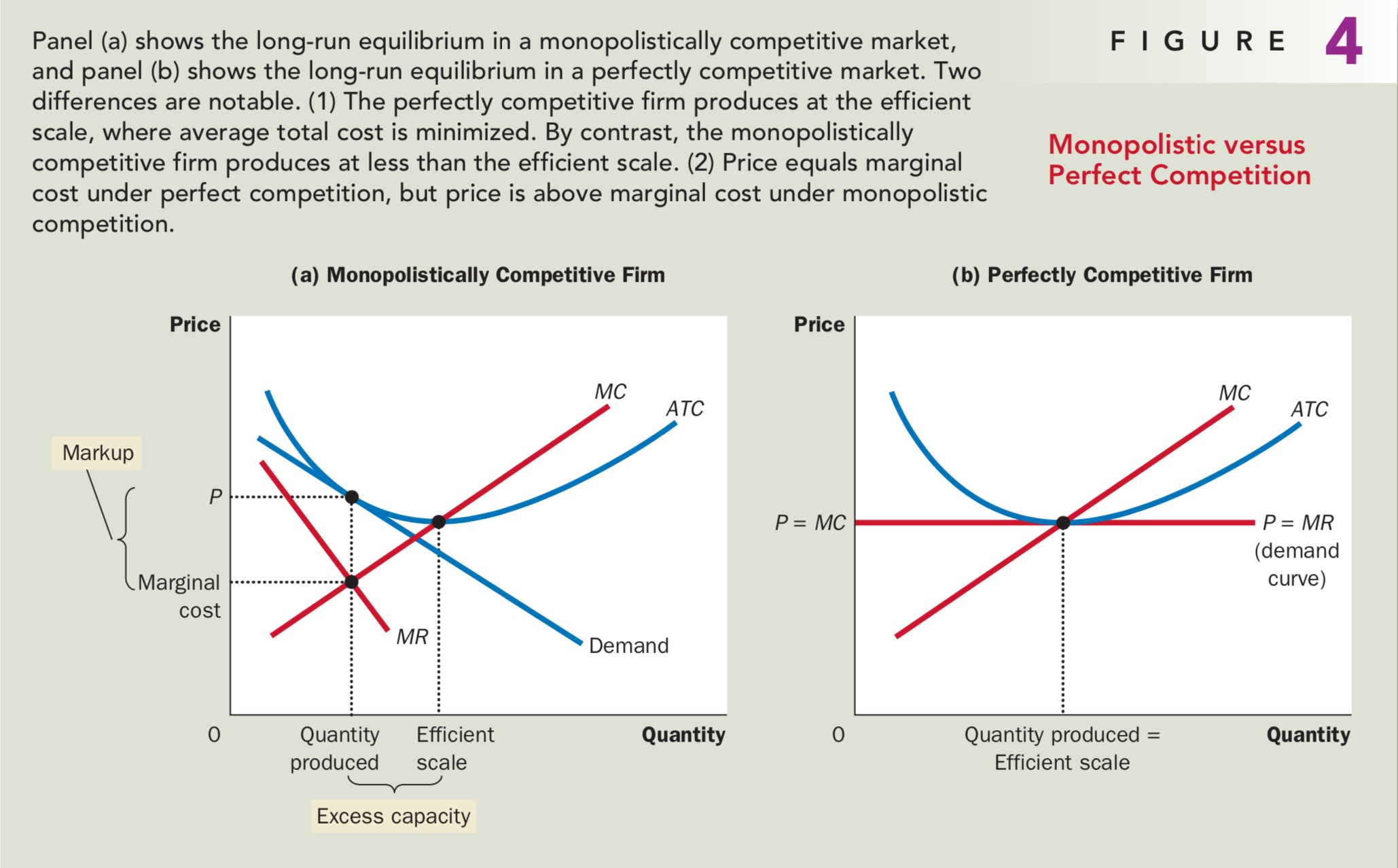

- 从完全竞争(side- by-side graph)/完全垄断/垄断竞争市场的图像中考察需求、供给曲线,弹性等

- Unit3-4一定会出1道题

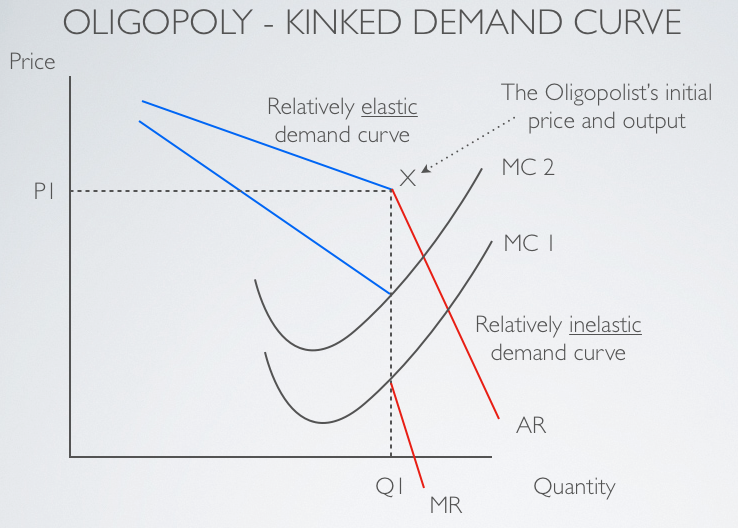

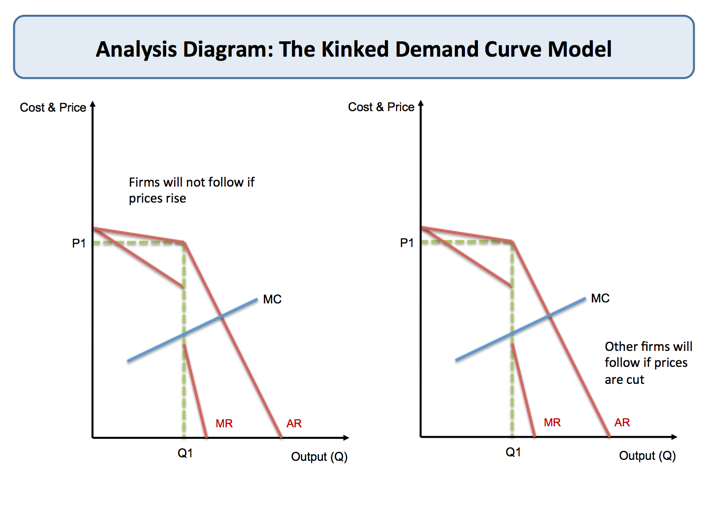

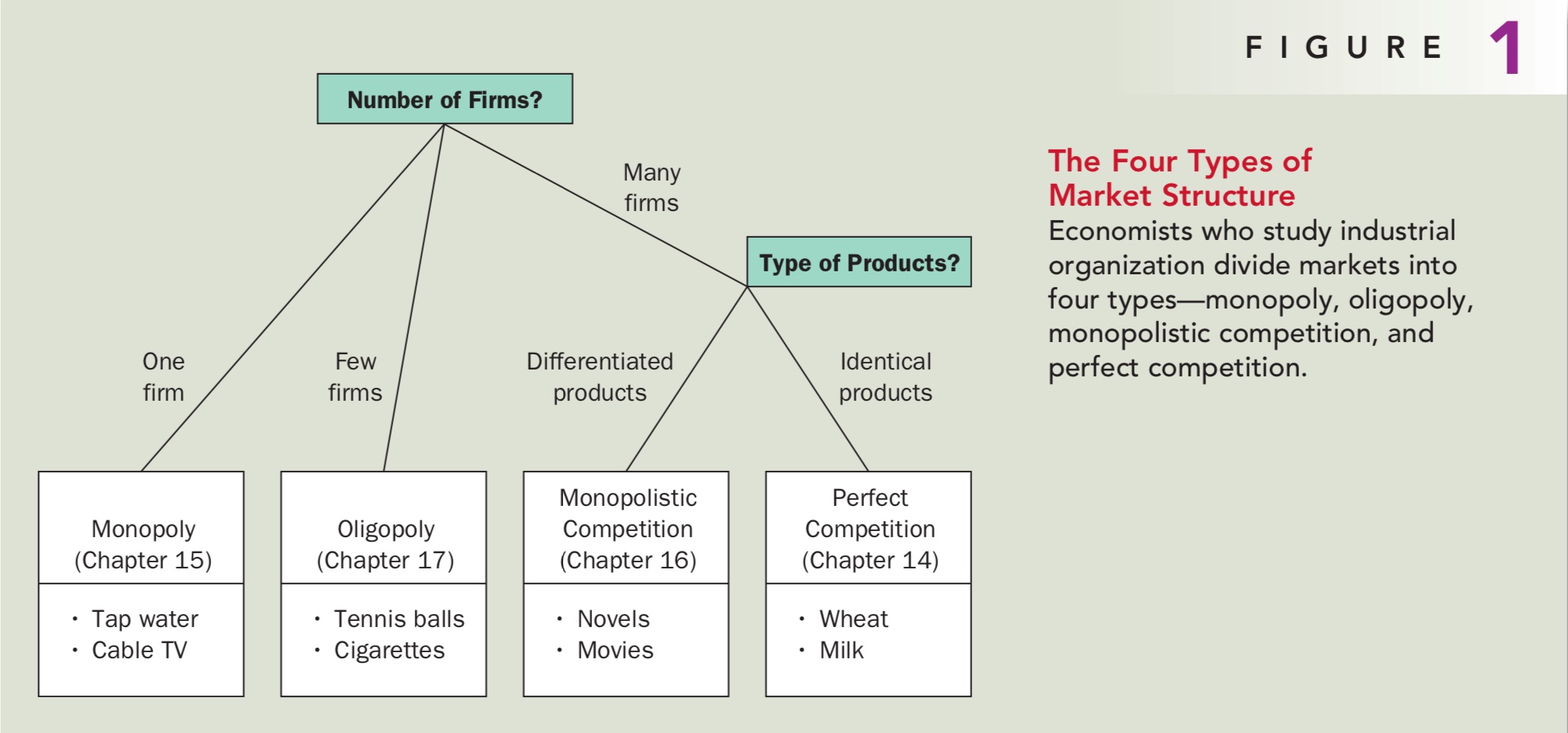

- 市场之间的转化(垄断竞争完全竞争、寡头垄断-完全垄断)

- 每个市场的图像变化及结论

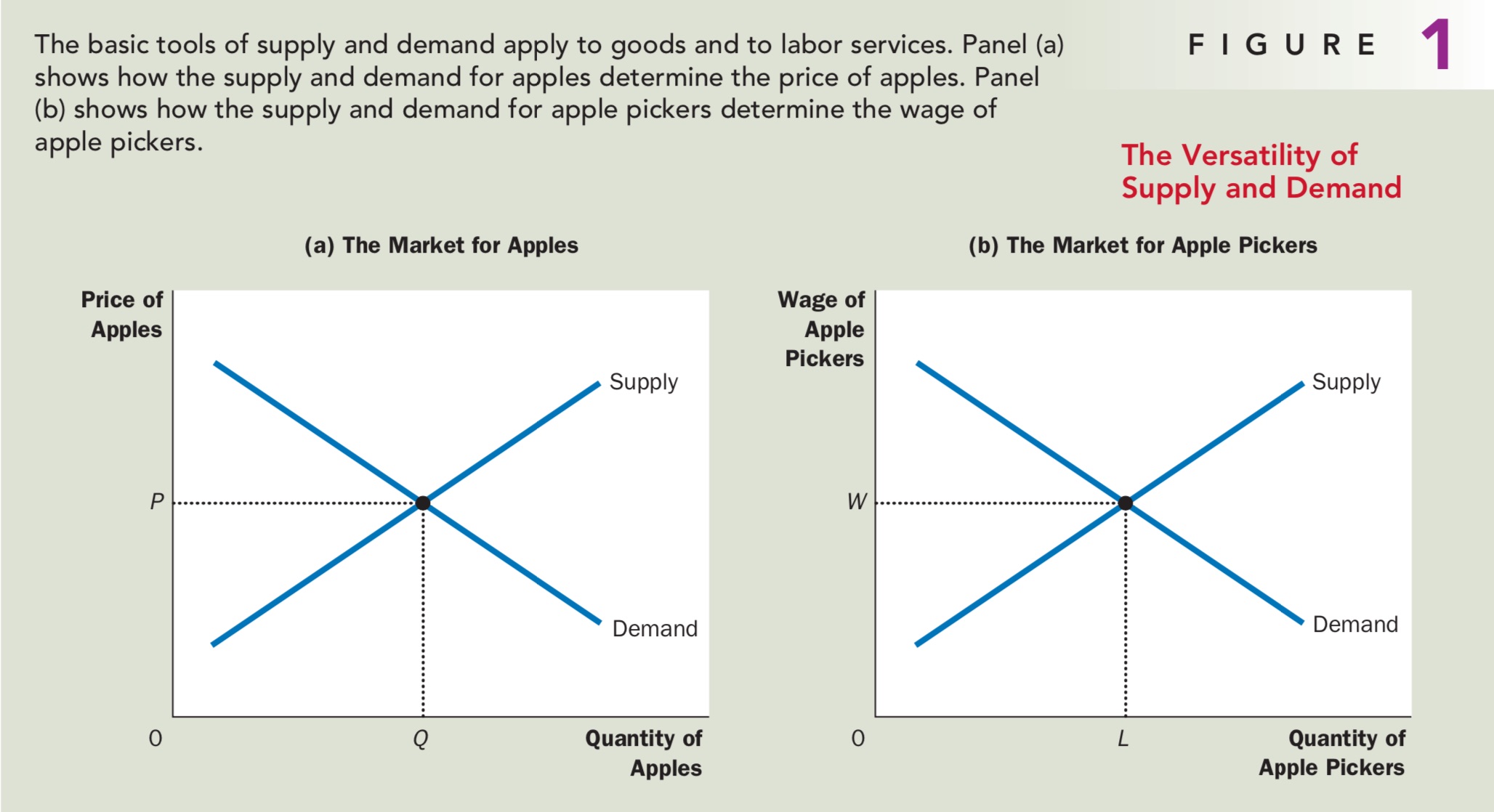

- Unit5有可能单独出题,其中一定会包含Unit2的知识点

Unit 1 - FRQ - 1

Nirali is a student at the University of Ainsley. She has 5 hours to study for two exams today. The tables below show Nirali’s expected scores given the amount of time she studies for each exam.

| Number of hours Spent Studying Microeconomics | Expected Score on Microeconomics exam (100-point scale) |

|---|---|

| 5 | 100 |

| 4 | 96 |

| 3 | 90 |

| 2 | 82 |

| 1 | 60 |

| 0 | 0 |

| Number of hours Spent Studying History | Expected Score on History exam (100-point scale) |

|---|---|

| 0 | 0 |

| 1 | 40 |

| 2 | 60 |

| 3 | 72 |

| 4 | 77 |

| 5 | 80 |

(a) Nirali spends 3 hours studying microeconomics and 2 hours studying history. Calculate her gain from the second hour spent studying history.

Solution: $40 \rightarrow 60$, $20$ points on History Exam.

(b) Calculate Nirali’s opportunity cost of the second hour spent studying history.

Solution: $6$ points on Microeconomics Exam.

(c) Assume Nirali increases the time she allocates to studying history. What happens to the opportunity cost of studying history? Explain

Solution: The opportunity cost of studying history will increase.

Explanation:

- Method 1: Expected score on Microeconmics decreases at an increasing rate for each hour spent on histroy.

- Method 2: Marginal cost is increasing.

(d) Assume that nirali has a goal of maximizing the sum of her test scores( the score on microeconomics plus the score on history). How many hours should she study for each exam?

Solution: She should study Microeconomics for $2$ hours and study Histroy for $3$ hours, which will enable her to achieve a total score of $154$ points, the maximum total score she can get.

(e) Nirali learns that her tennis practice has been canceled, freeing up an additional hour for studying. Given your answer to part(d), will Nirali allocate the additional hour to studying microeconomics or to studying history to maximize the sum of her test scores? Explain using marginal analysis

Solution: She will allocate the additional hour to studying microeconomics.

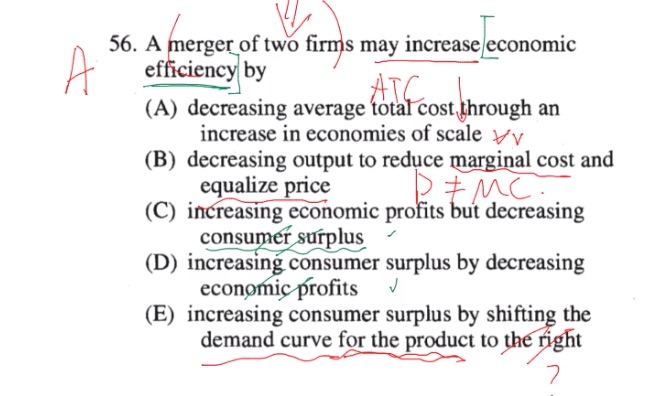

Explanation: Because the marginal benefit of learning an additional hour of microeconomics is $90 - 82 = 8$ points and the marginal benefit of learning an additional hour of history is $77 - 72 = 5$. $8 > 5$.

Unit 1 - FRQ - 2

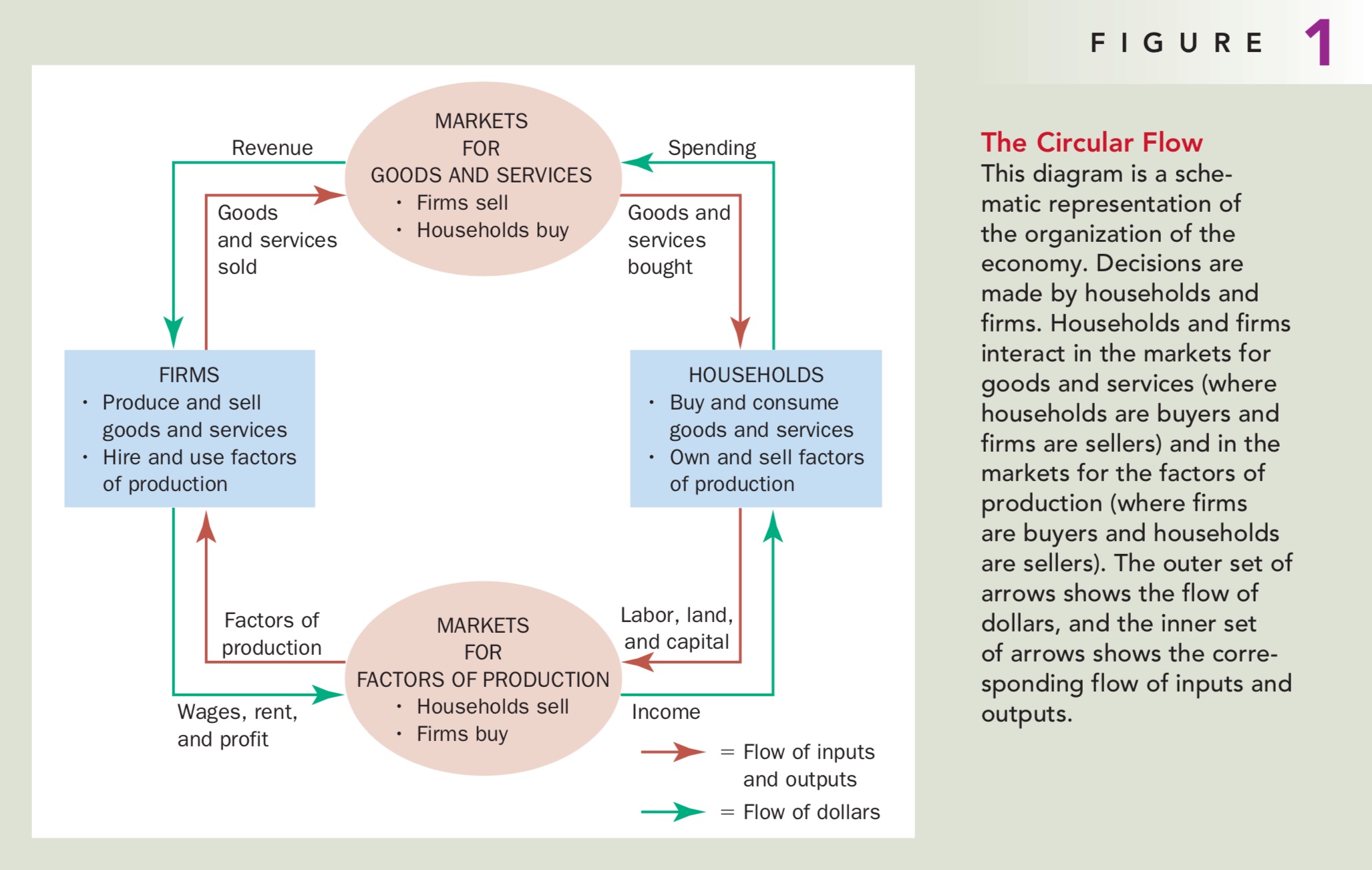

Sasha is a utility-maximizing consumer who spends all of her income on peanuts and bananas, both of which are normal goods

- (a) Assume that the last unit of peanuts consumed increased Sasha’s total utility from 40 utils to 48 utils and that the last unit of bananas consumed increased her total utility from 52 utils to 56 utils

- (i) If the price of a unit of peanuts is SI and Sasha is maximizing utility, calculate the price of a unit of bananas

- Solution: Thus the price of banana is $(56 - 52) \div (48 - 40) \times 1 = 0.5$ dollars

- (ii) If the price of a unit of peanuts increases and the price of a unit of bananas remains unchanged from the price you determined in part(a)(i), how will Sasha’s purchase of peanuts change?

- Solution: She will purchase less peanuts.

- (b) Assume that the cross-price elasticity of demand between peanuts and bananas is positive. A widespread disease has destroyed the banana crop. What will happen to the equilibrium price and quantity of peanuts in the short run? Explain

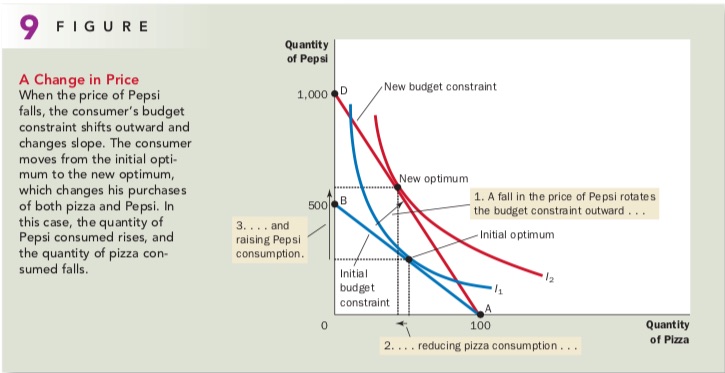

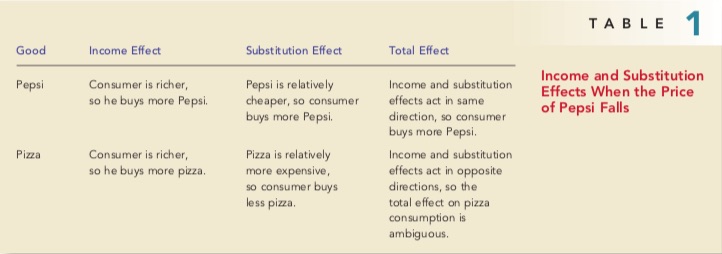

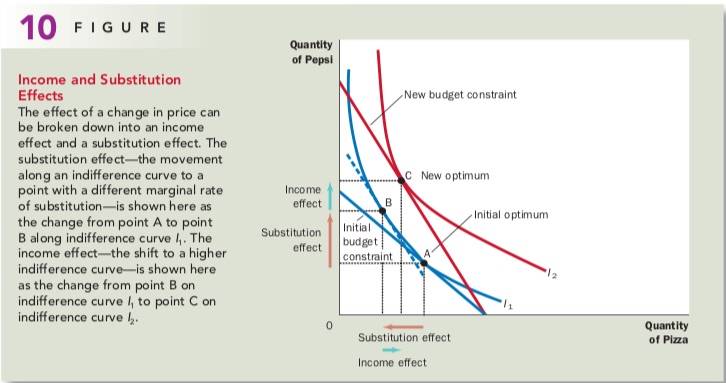

- (c) Assume that the price of bananas increases.

- (i) Will the substitution effect increase, decrease, or have no effect on the quantity of bananas demanded?

- (ii) What happens to Sasha’s real income?

Unit 2 - FRQ - 1

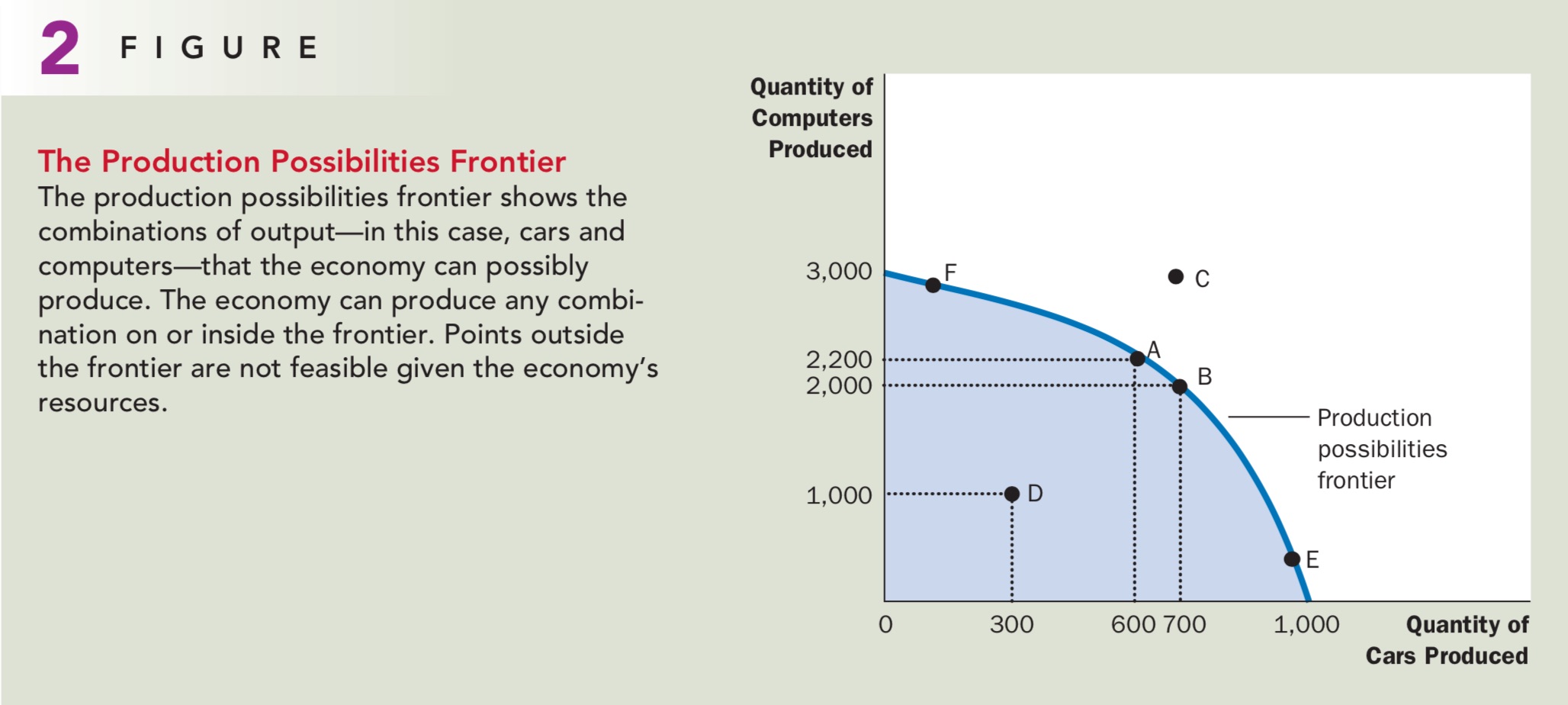

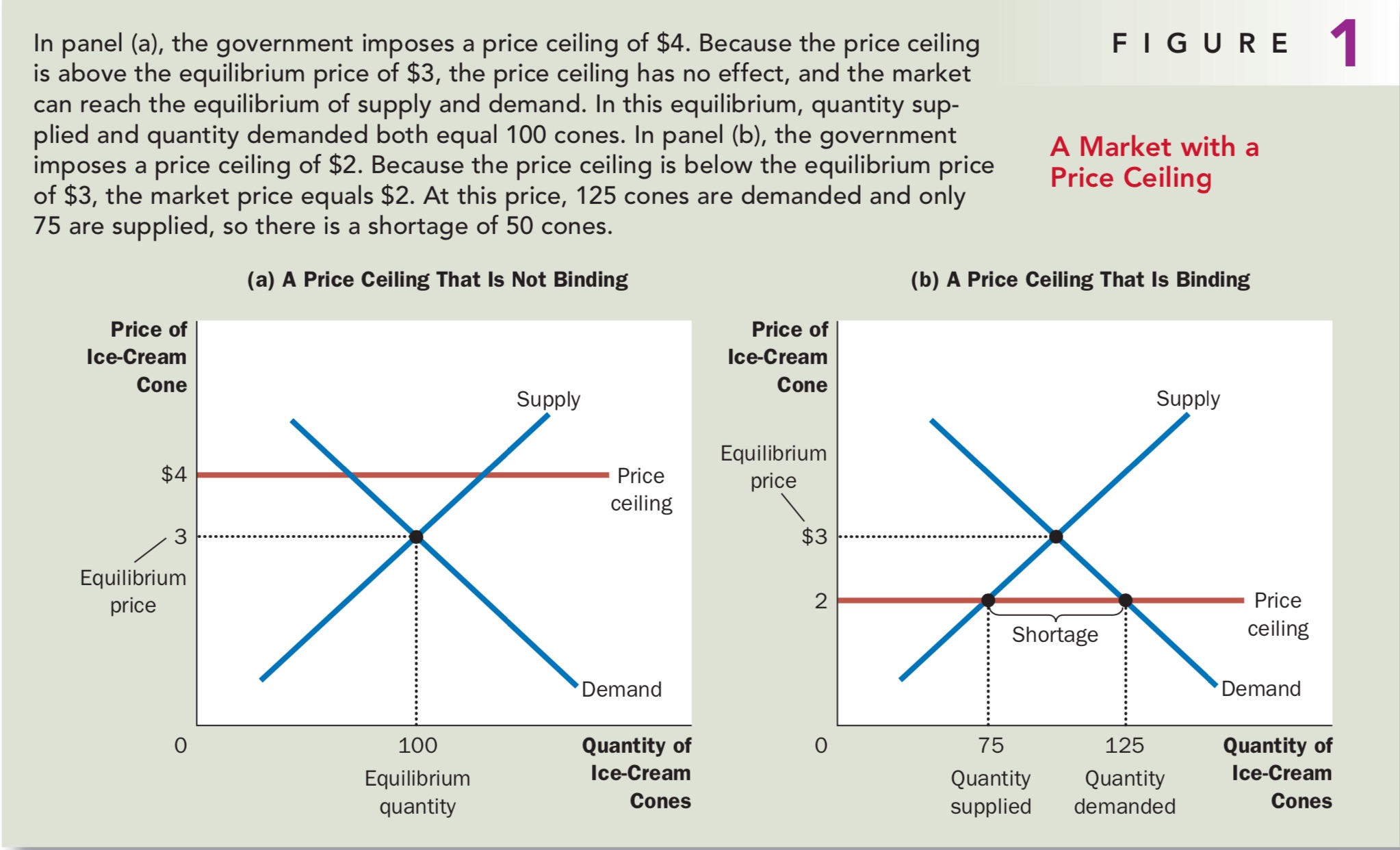

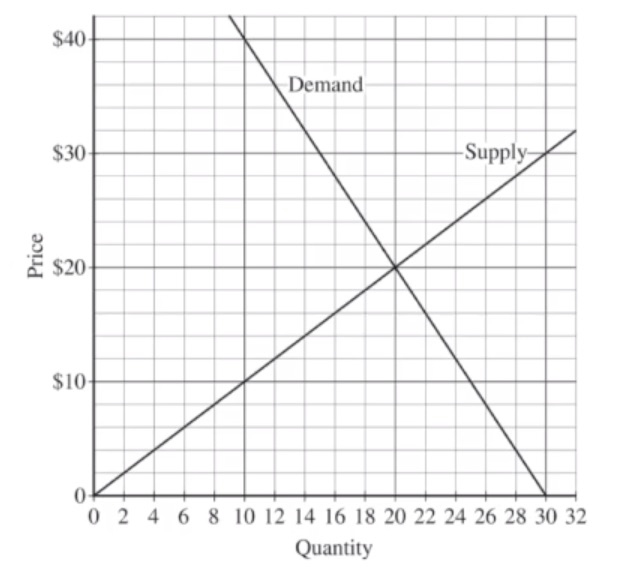

The graph below shows the market for widgets. The government is considering intervening in this market.

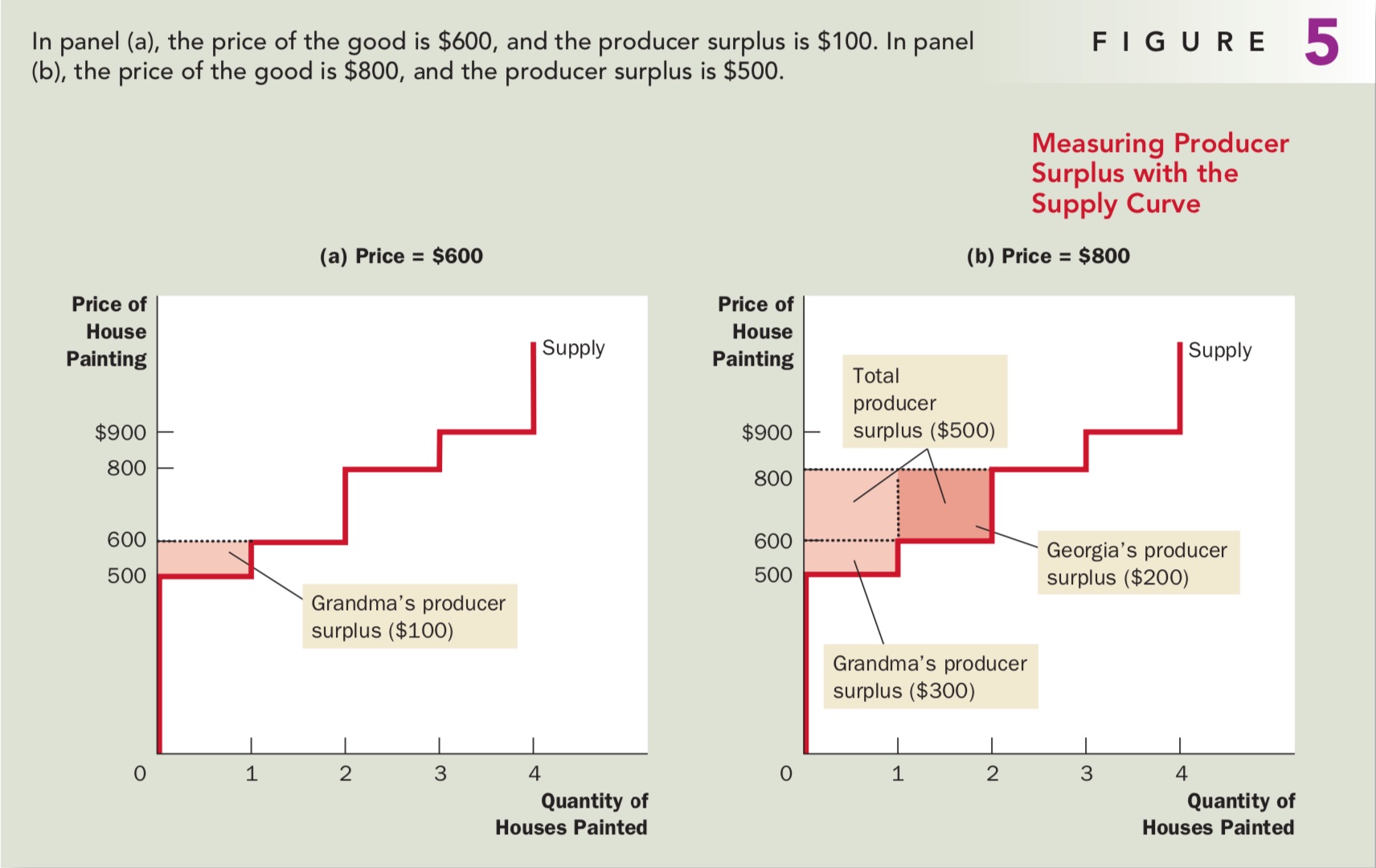

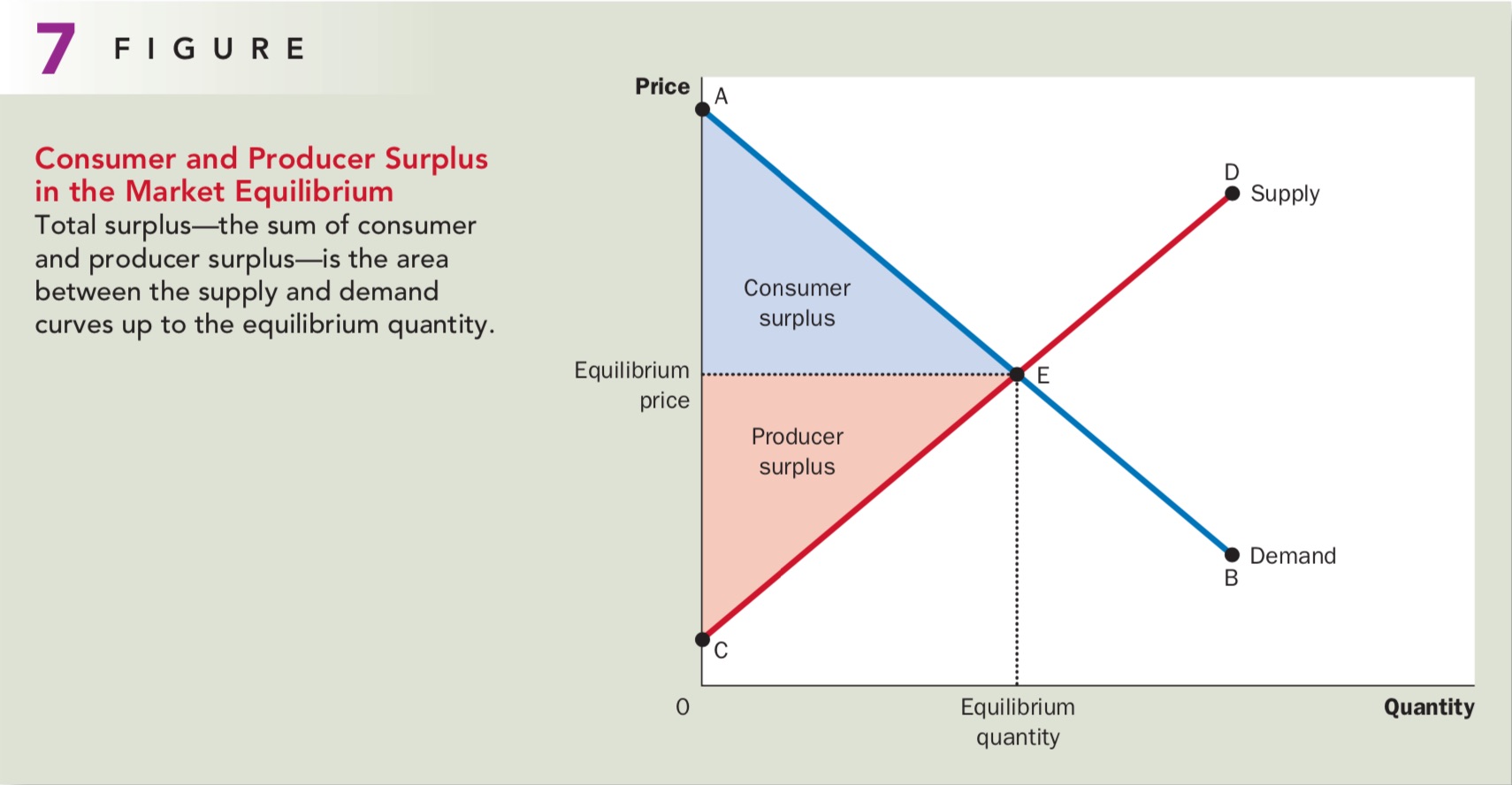

- (a) Calculate the total producer surplus at the market equilibrium price and quantity. Show your work.

- Solution: $20 \times 20 \div 2 = 200$ dollars

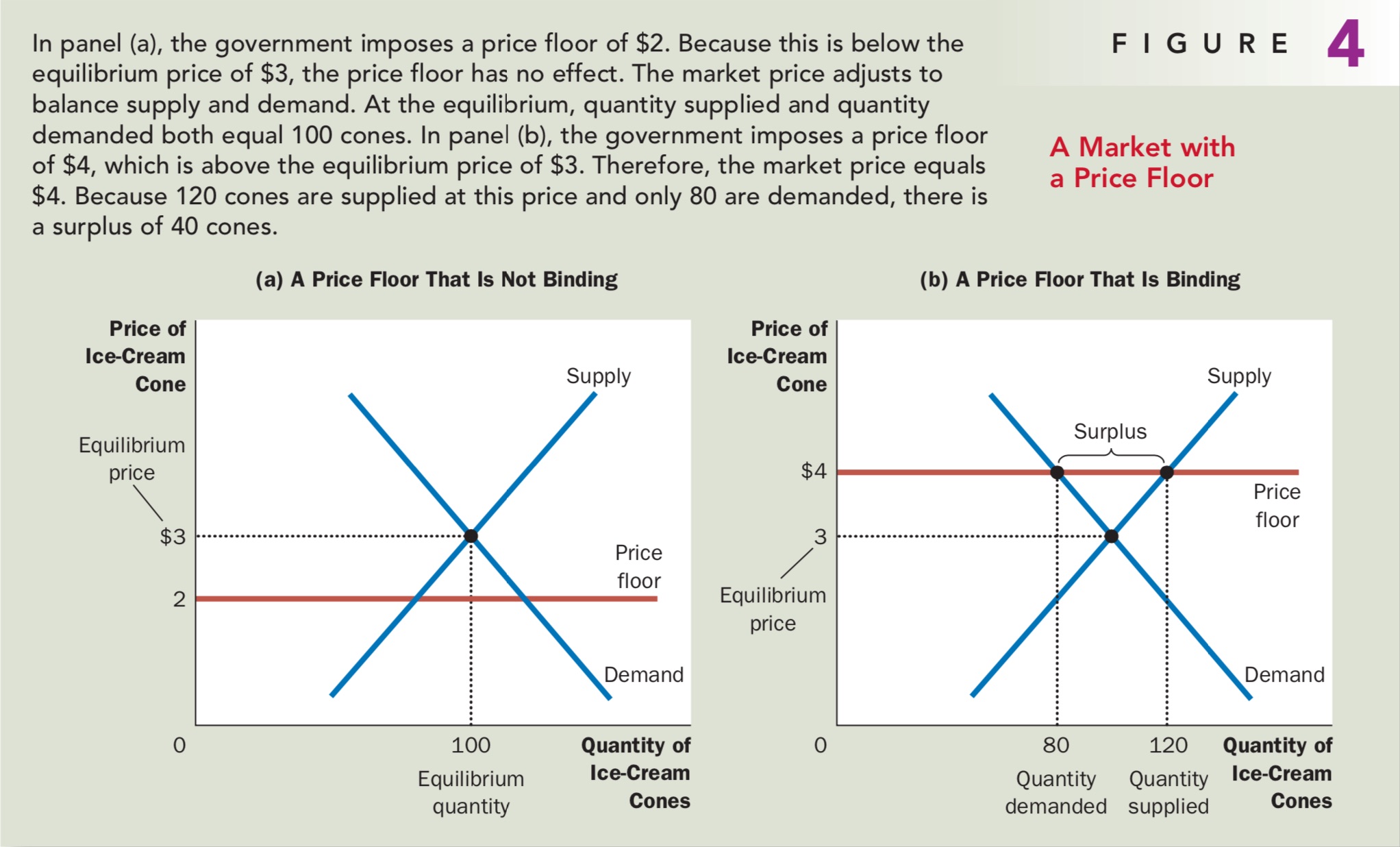

- (b) If the government imposes a price floor at $16, is there a shortage, a surplus, or neither? Explain

- Solution: Neither, because the price floor is below the equilibrium, thus it is not binding / not effective / ineffective.

- (c) If instead the government imposes a price ceiling at $12, is there a shortage, a surplus, or neither? Explain

- Solution: There will be a shortage, because the price ceiling is below the equilibrium and $Q_D > Q_S$ (Quantity Demanded is greater than Quantity Supplied).

- (d) If instead the government restricts the market output to 10 units, calculate the deadweight loss. Show your work.

- Solution: $(40 - 10) \times (20 - 10) \div 2 = 150$ dollars.

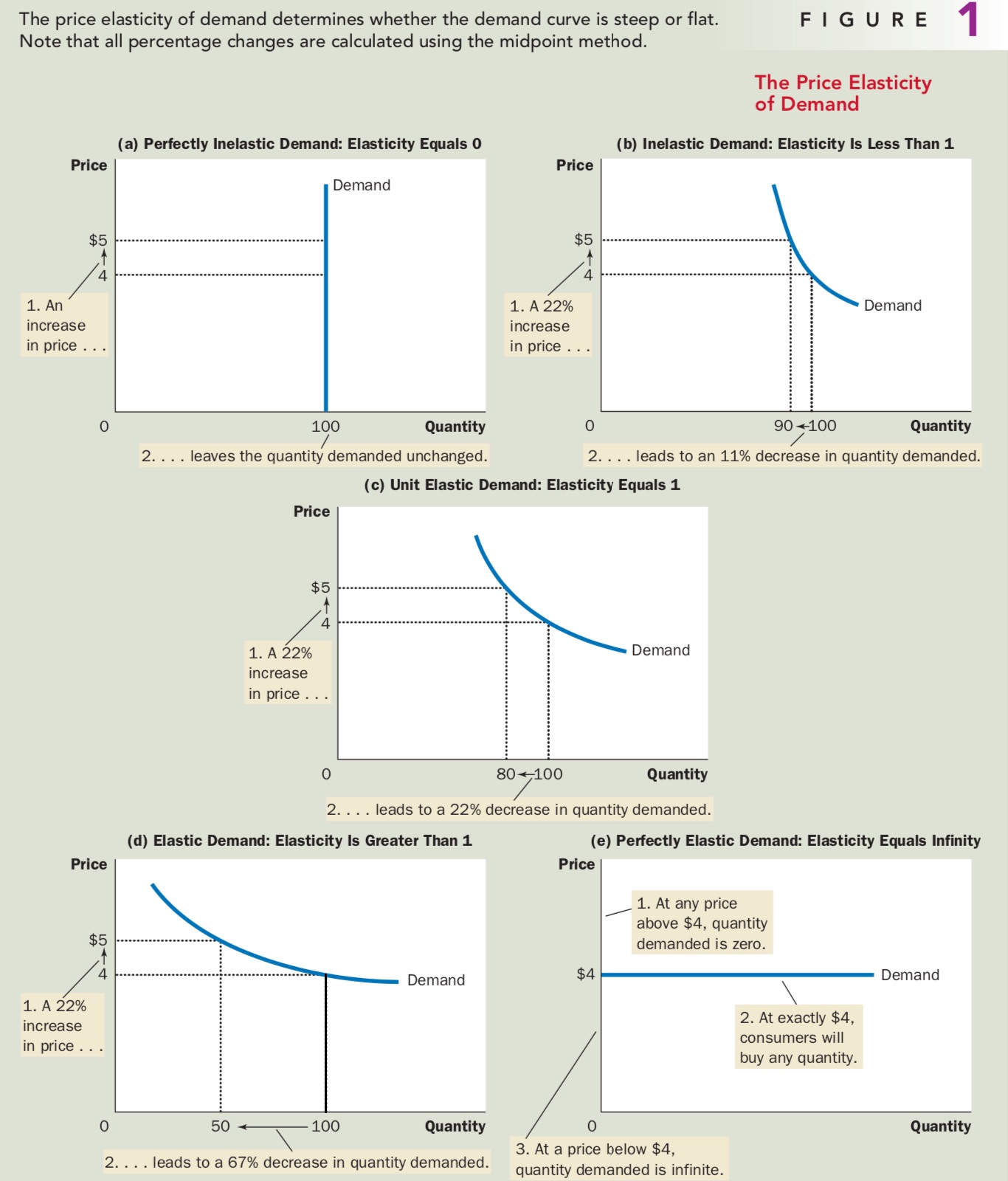

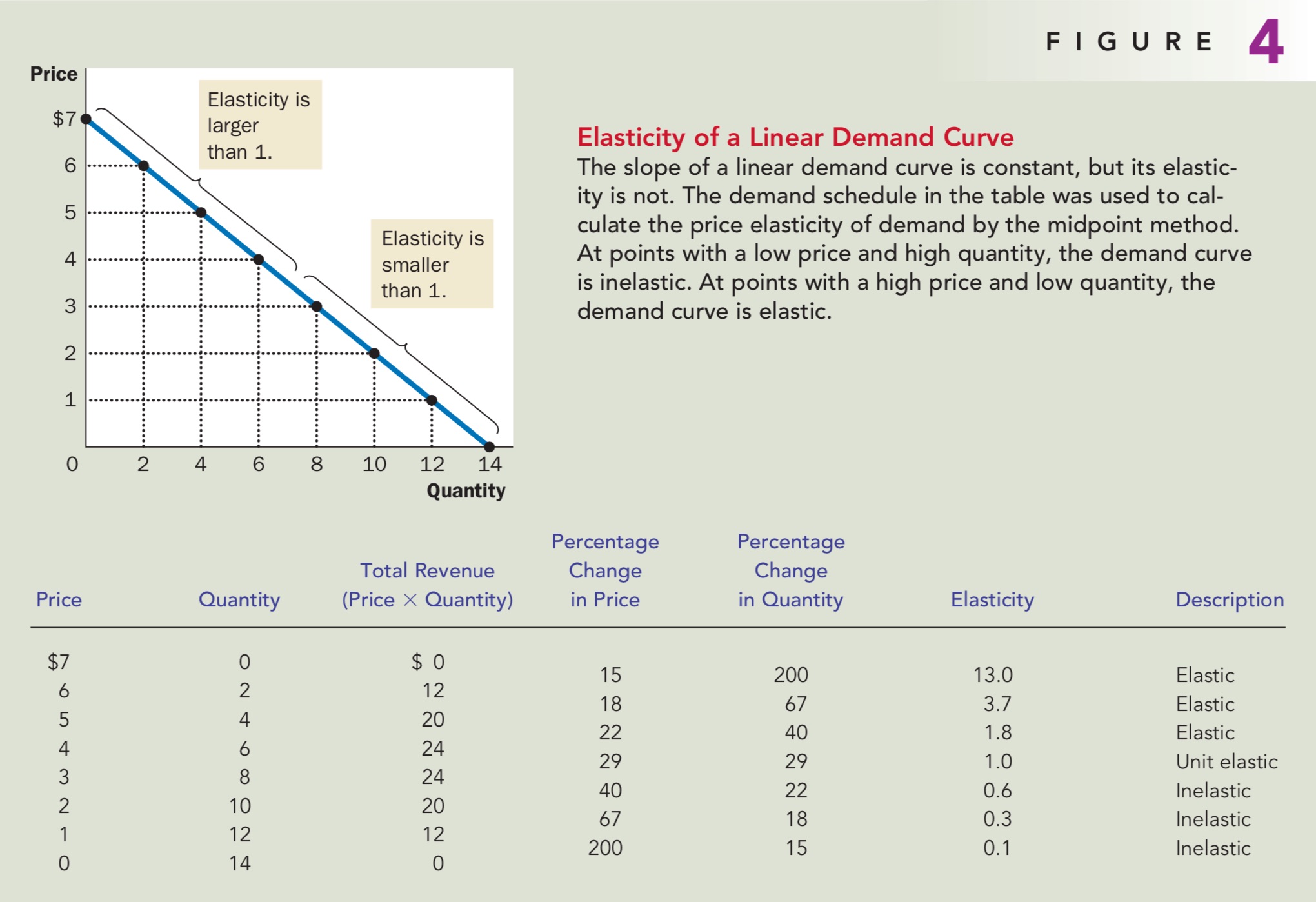

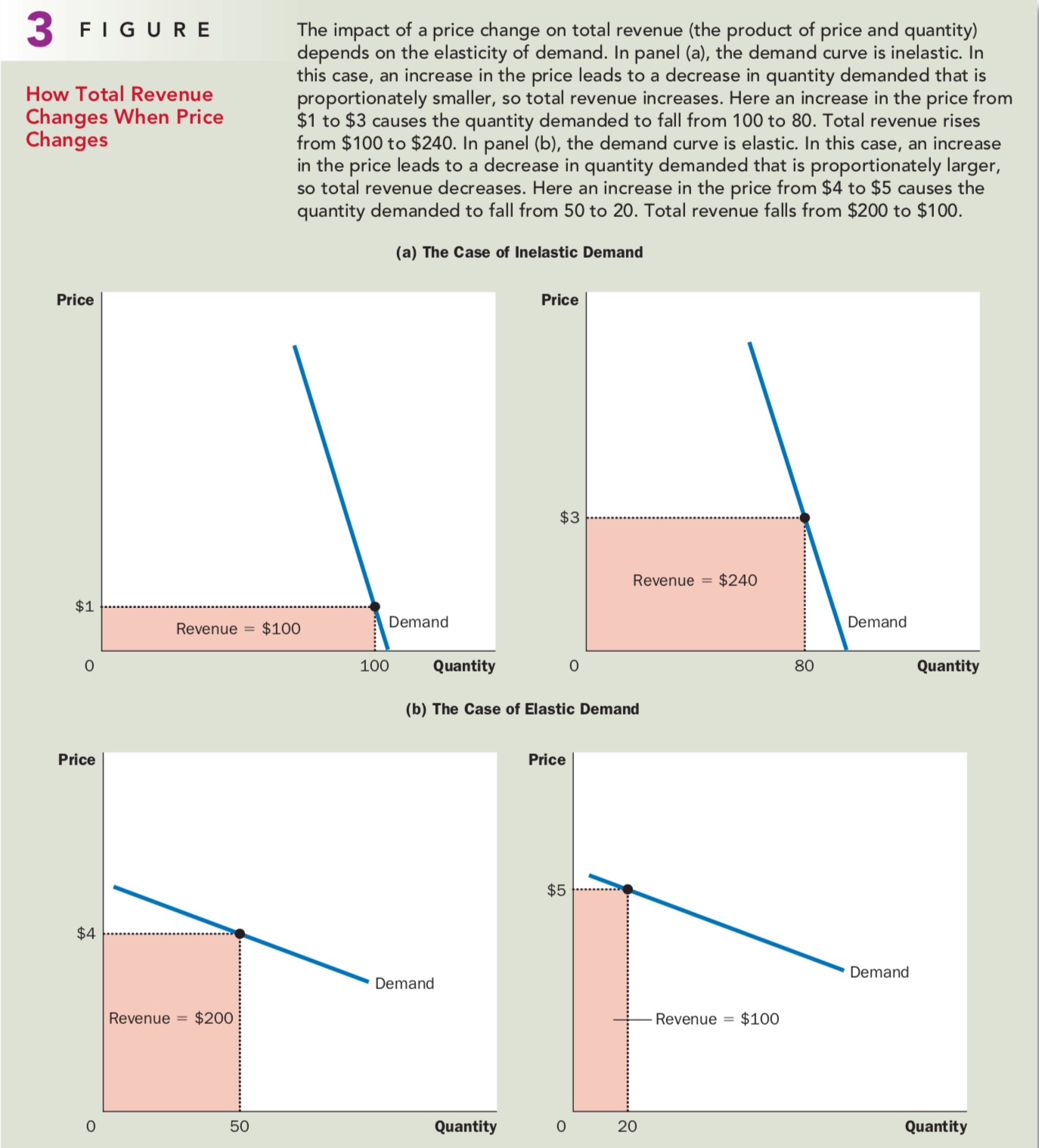

- (e) Assume the price decreases from 20 dollars to 12 dollars.

- (i) Calculate the price elasticity of demand. Show your work.

- Solution:

- (ii) In this price range, is demand perfectly elastic, relatively elastic, unit elastic, relatively inelastic, or perfectly inelastic?

- Solution: Since $\varepsilon < 1$, the demand is relatively inelastic in this price range.

Unit 2 - FRQ - 2

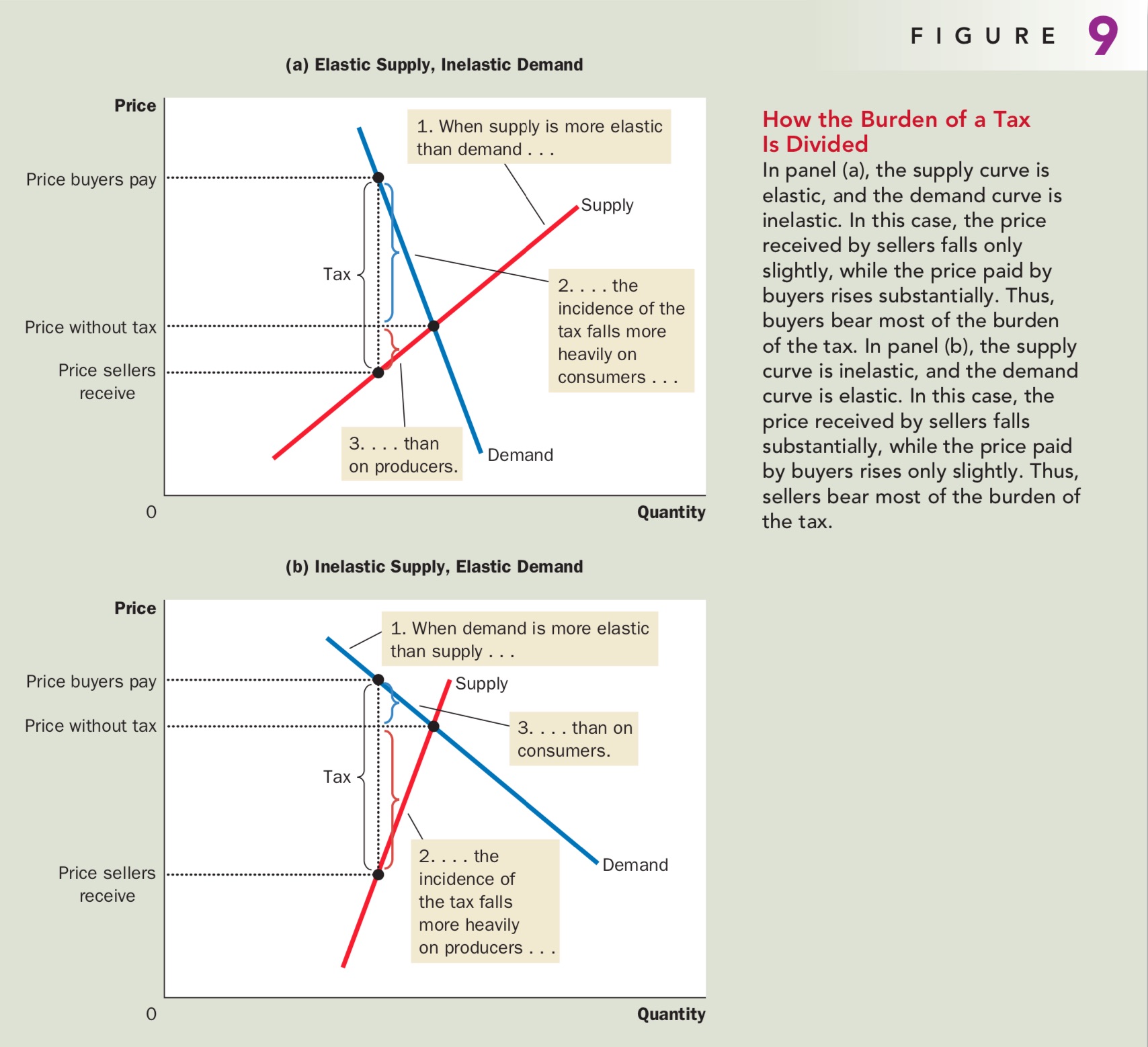

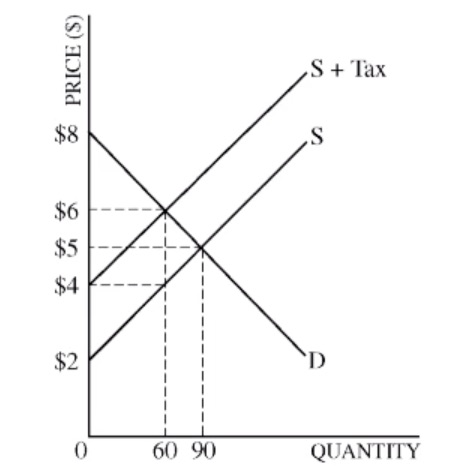

The graph above illustrates the market for calculators. S denotes the current supply curve, and D denotes the demand curve.

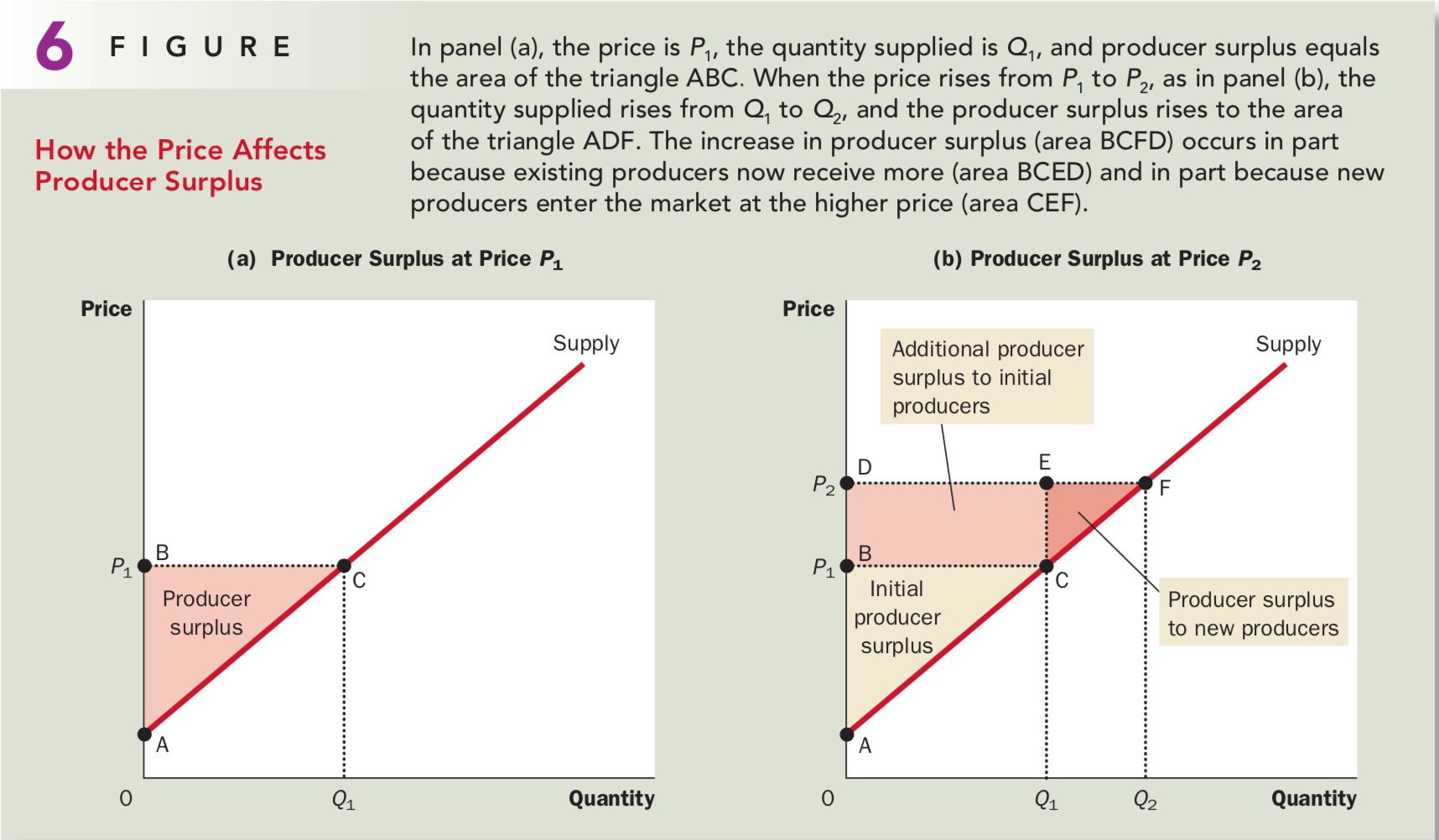

- (a) Calculate the producer surplus before the tax

- Solution: $(5 - 2) \times 90 \div 2 = 135$ dollars.

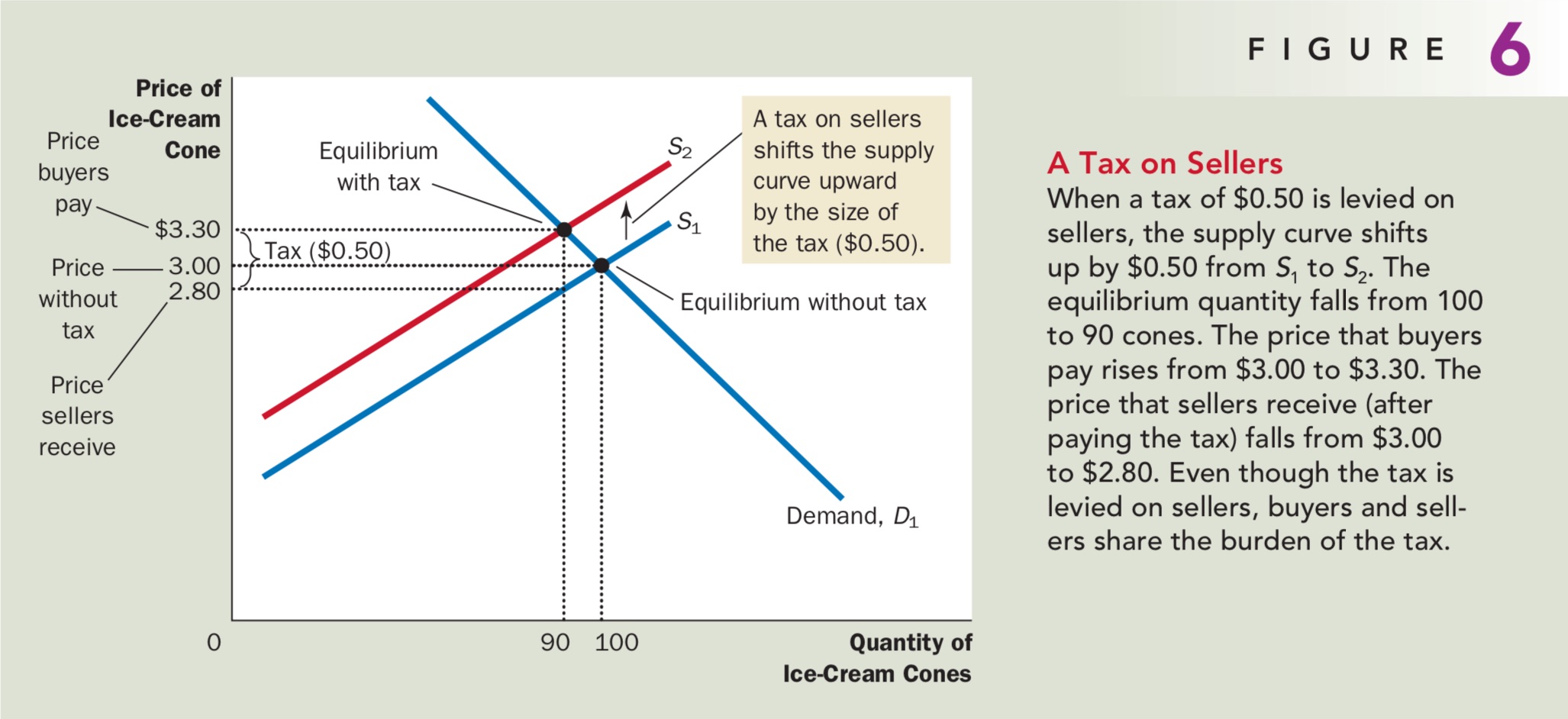

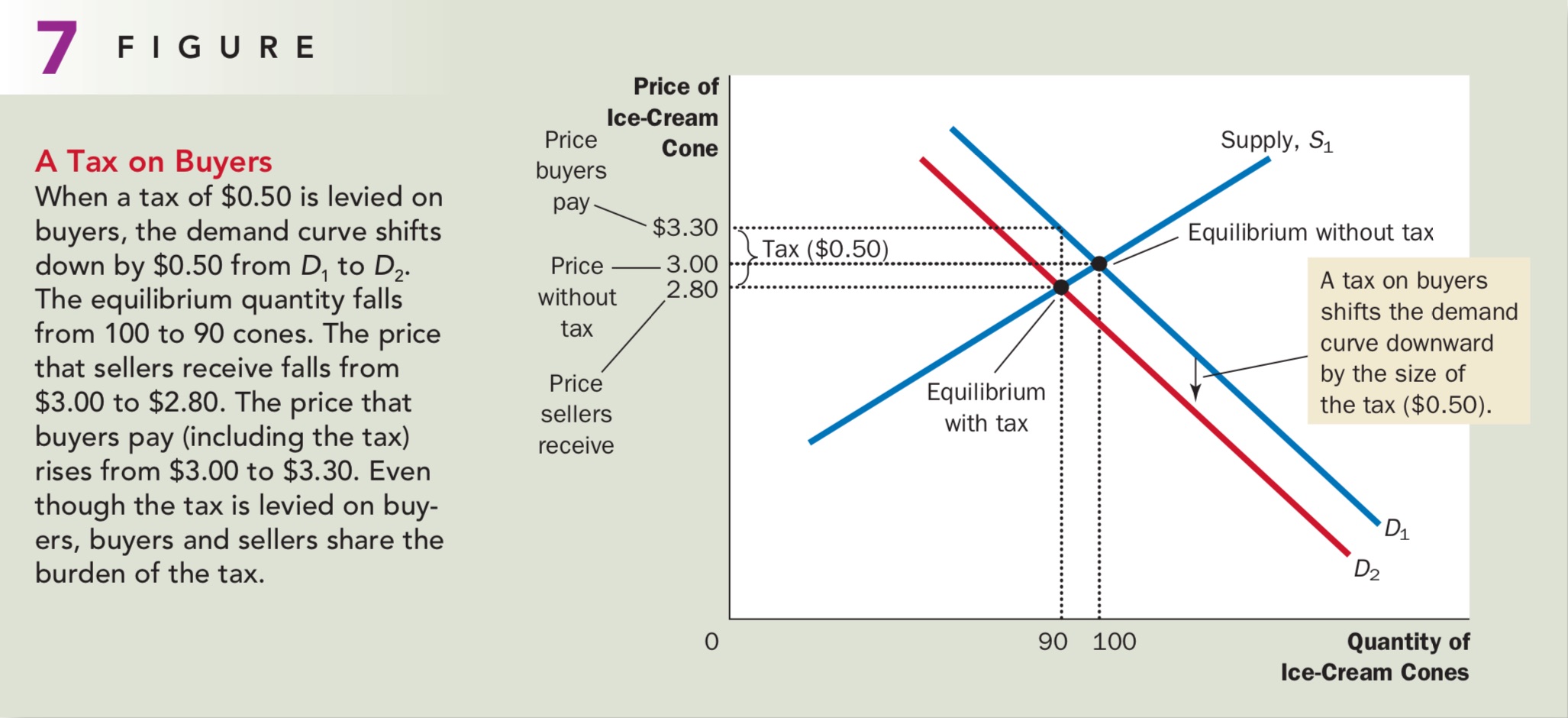

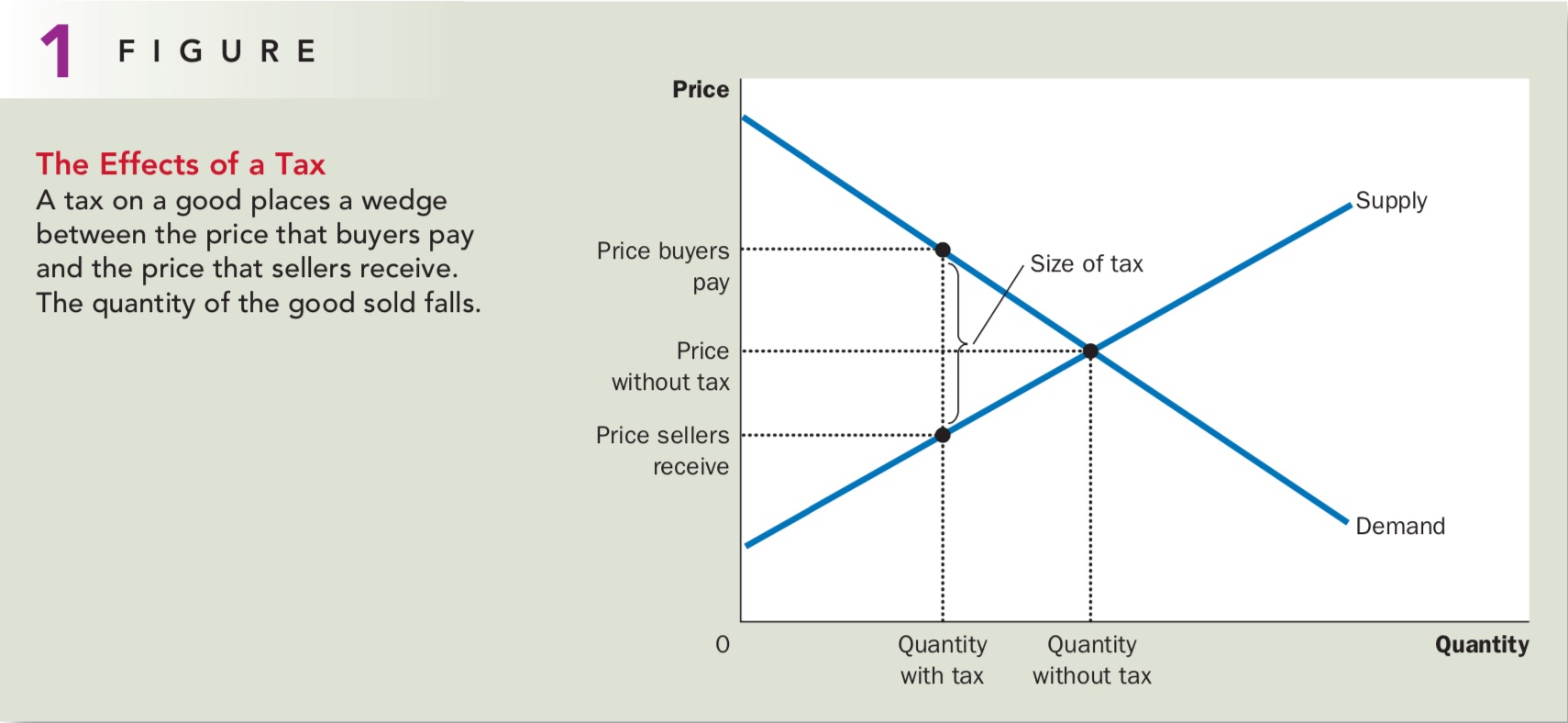

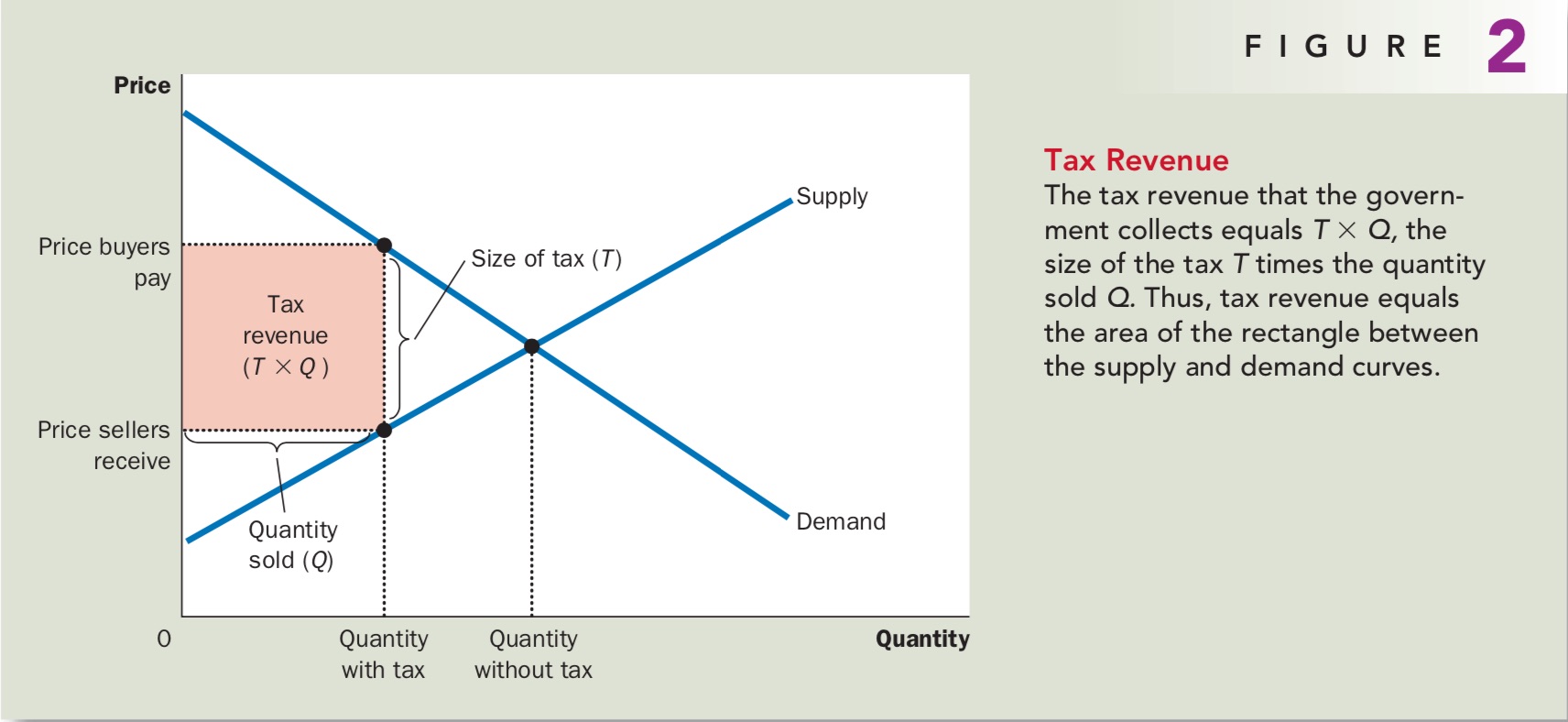

- (b) Now assume a per-unit tax of $2 is imposed whose impact is shown in the graph above.

- (i) Calculate the amount of tax revenue.

- Solution: $2 \times 60 = 120$ dollars.

- (ii) What is the after-tax price that the sellers now keep?

- Solution: $4$ dollars.

- (iii) Calculate the producer surplus after the tax.

- Solution: $(4 - 2) \times 60 \div 2 = 60$ dollars.

- (c) Is the demand price elastic, inelastic, or unit elastic between the prices of 5 dollars and 6 dollars? Explain.

- Solution:

- Method 1:Since $\varepsilon > 1$, the demand price is elastic between the prices of 5 dollars and 6 dollars.

- Method 2: When price change from $5$ dollars to $6$ dollars, the total revenue decreases, thus the price demand is elastic.

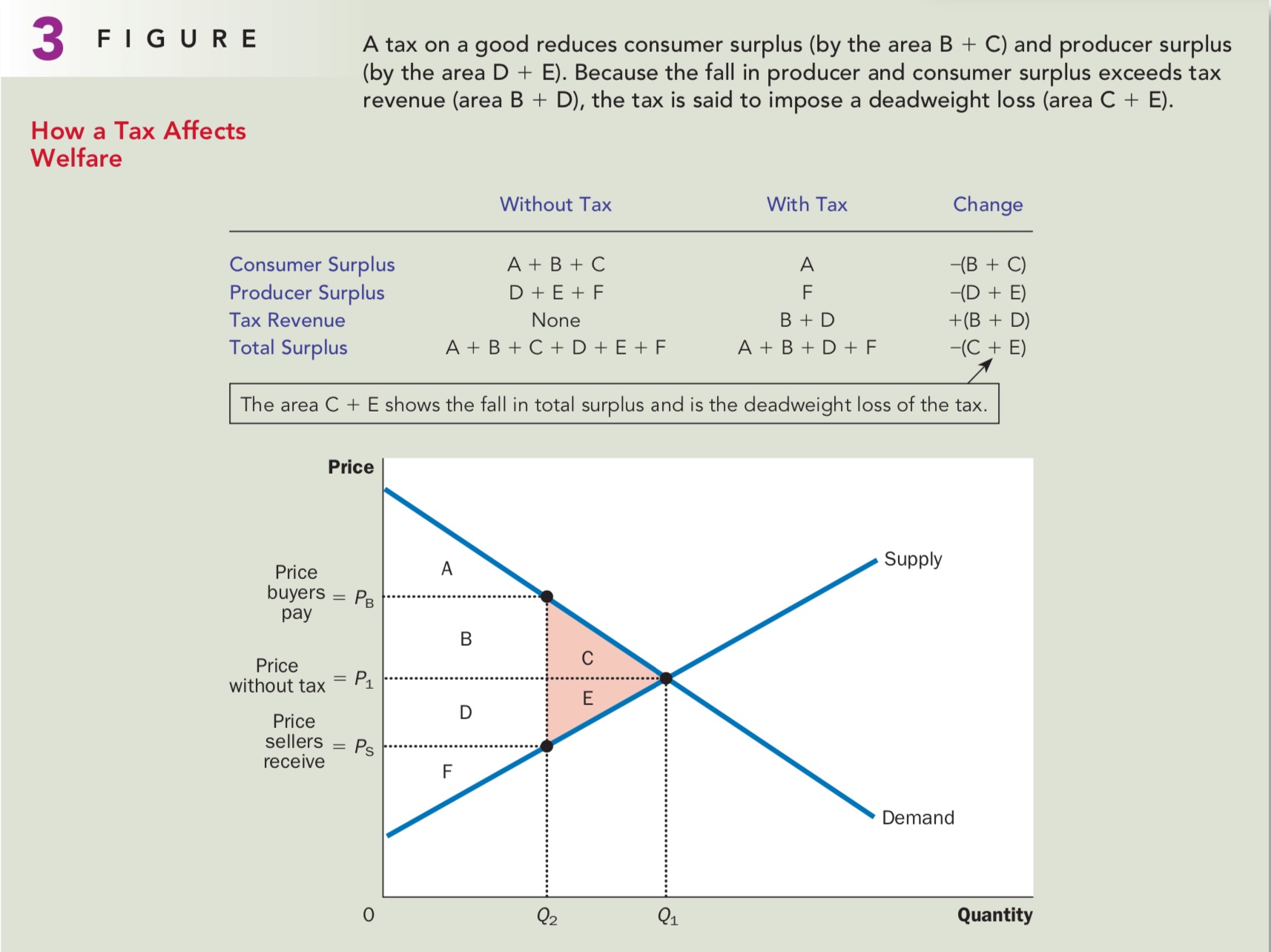

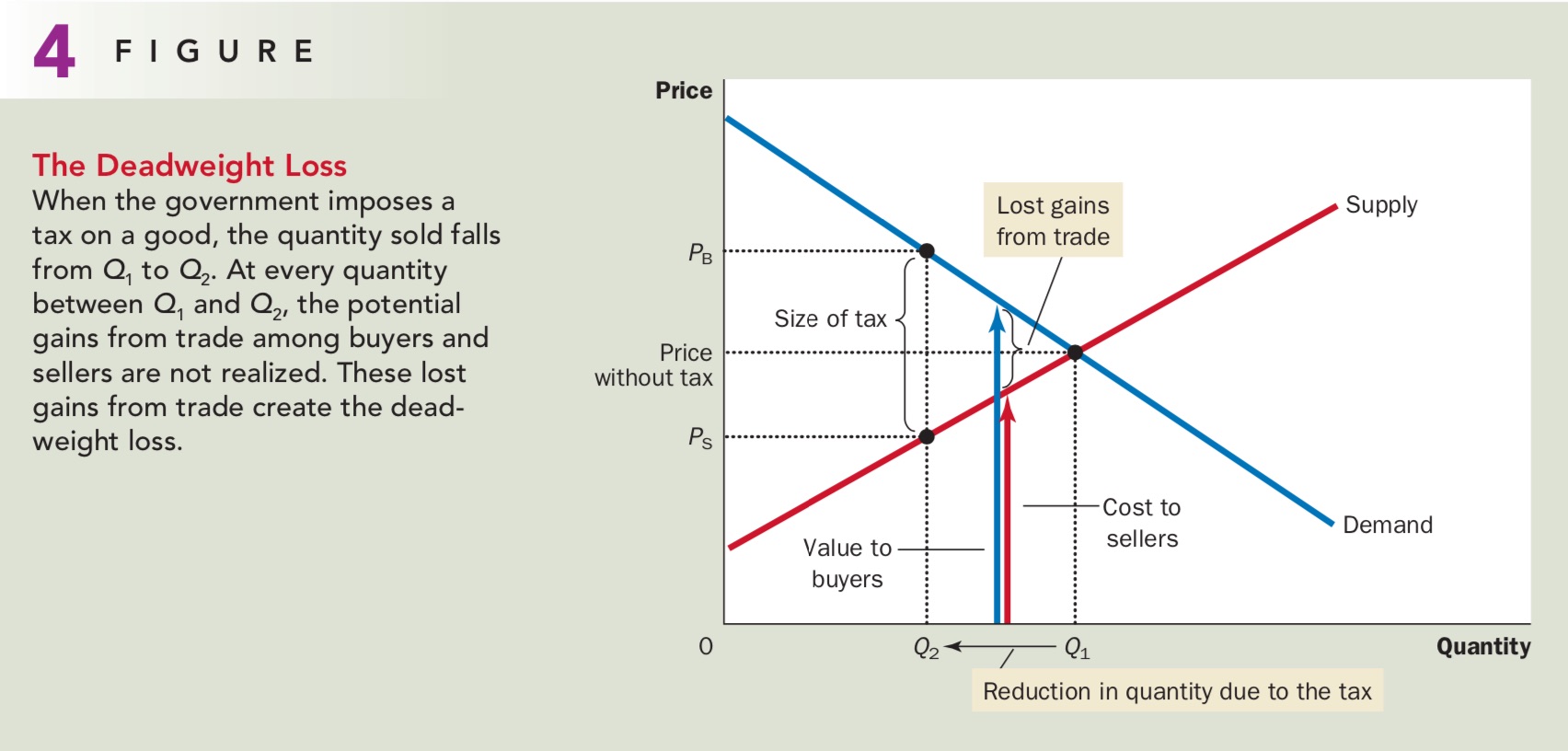

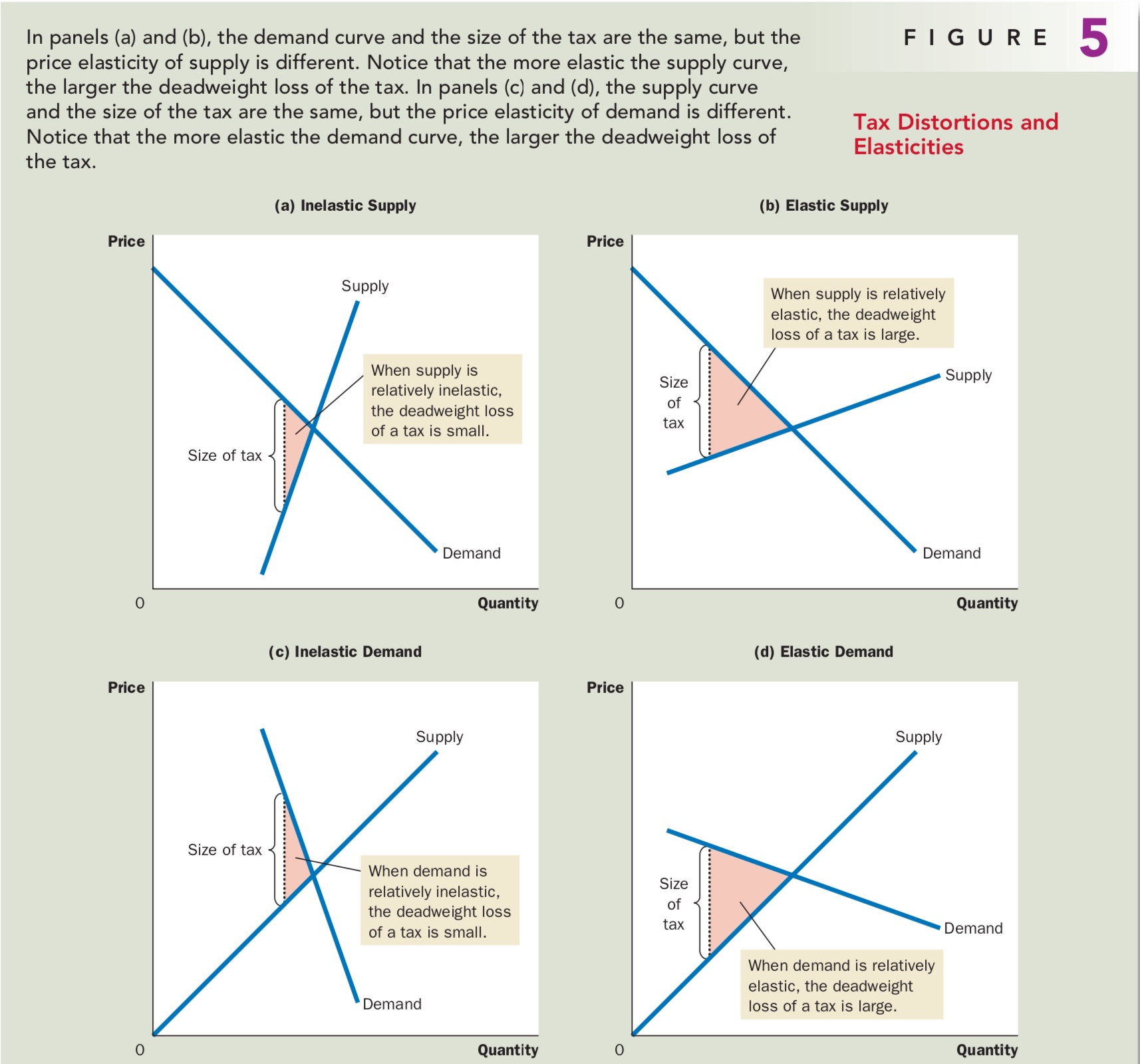

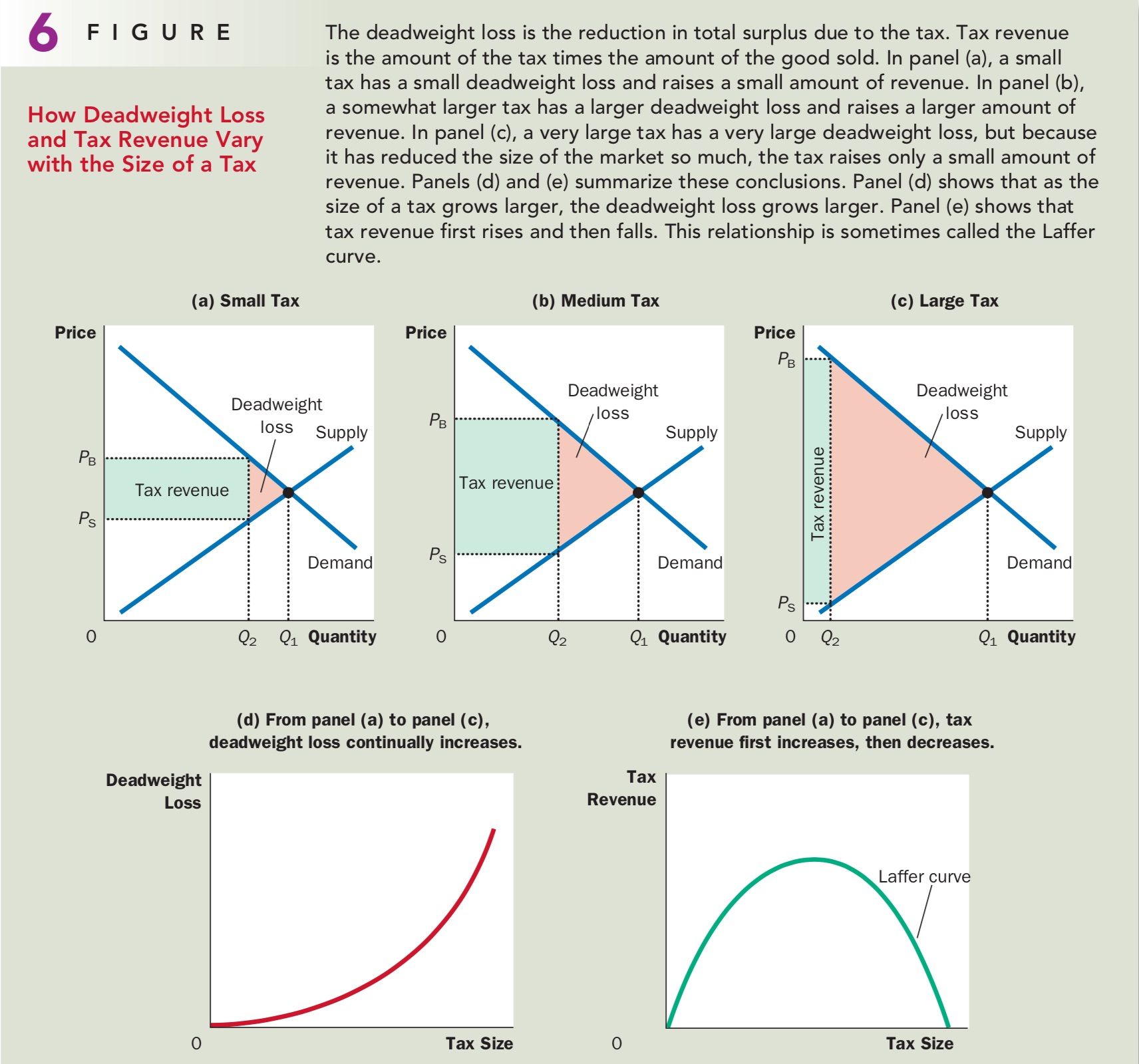

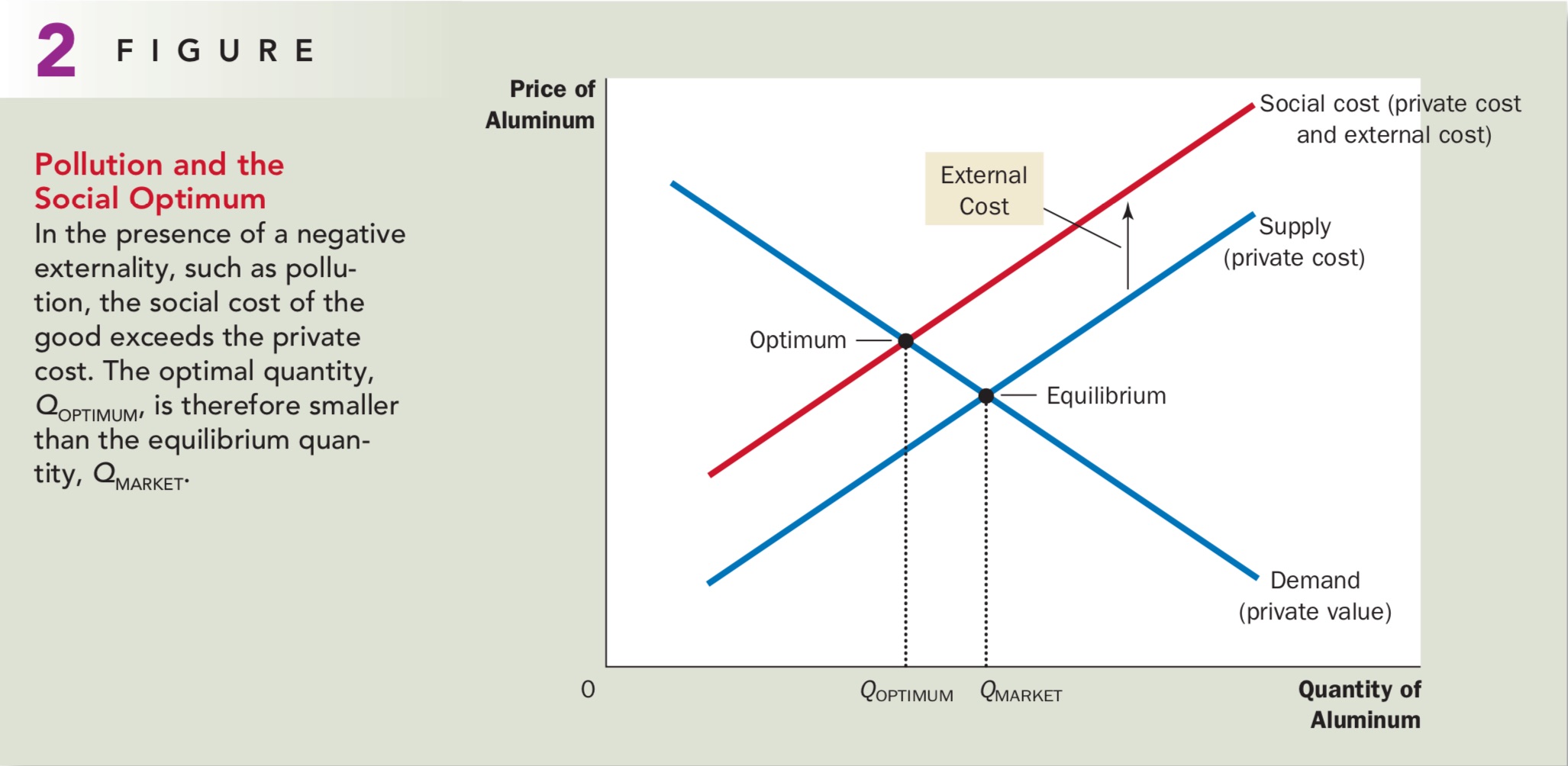

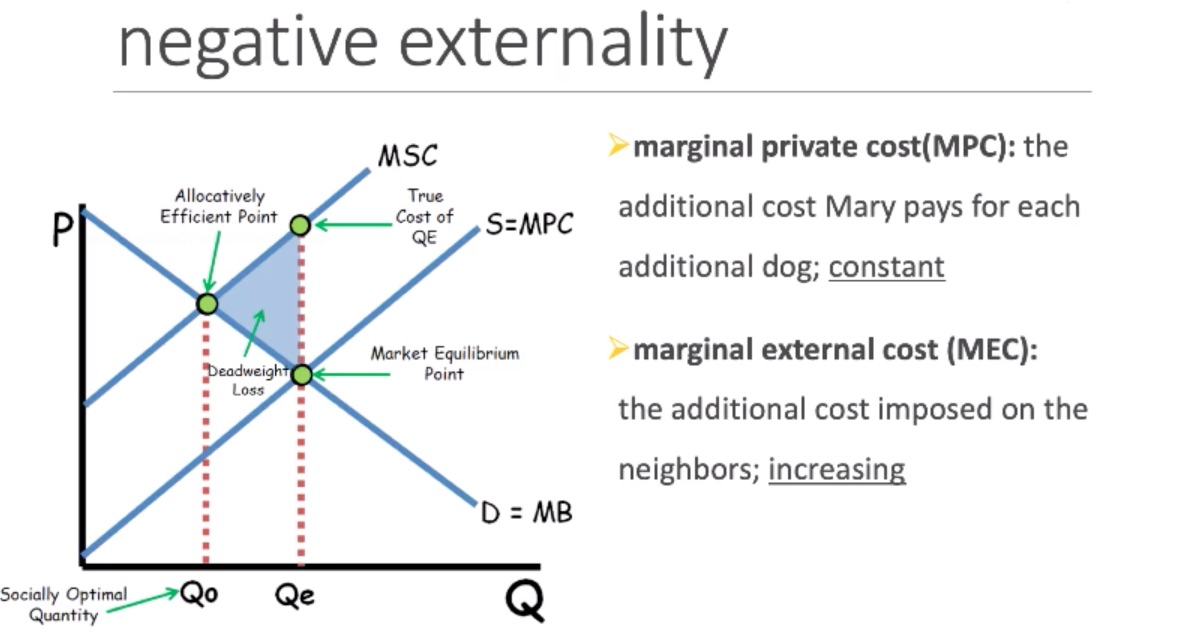

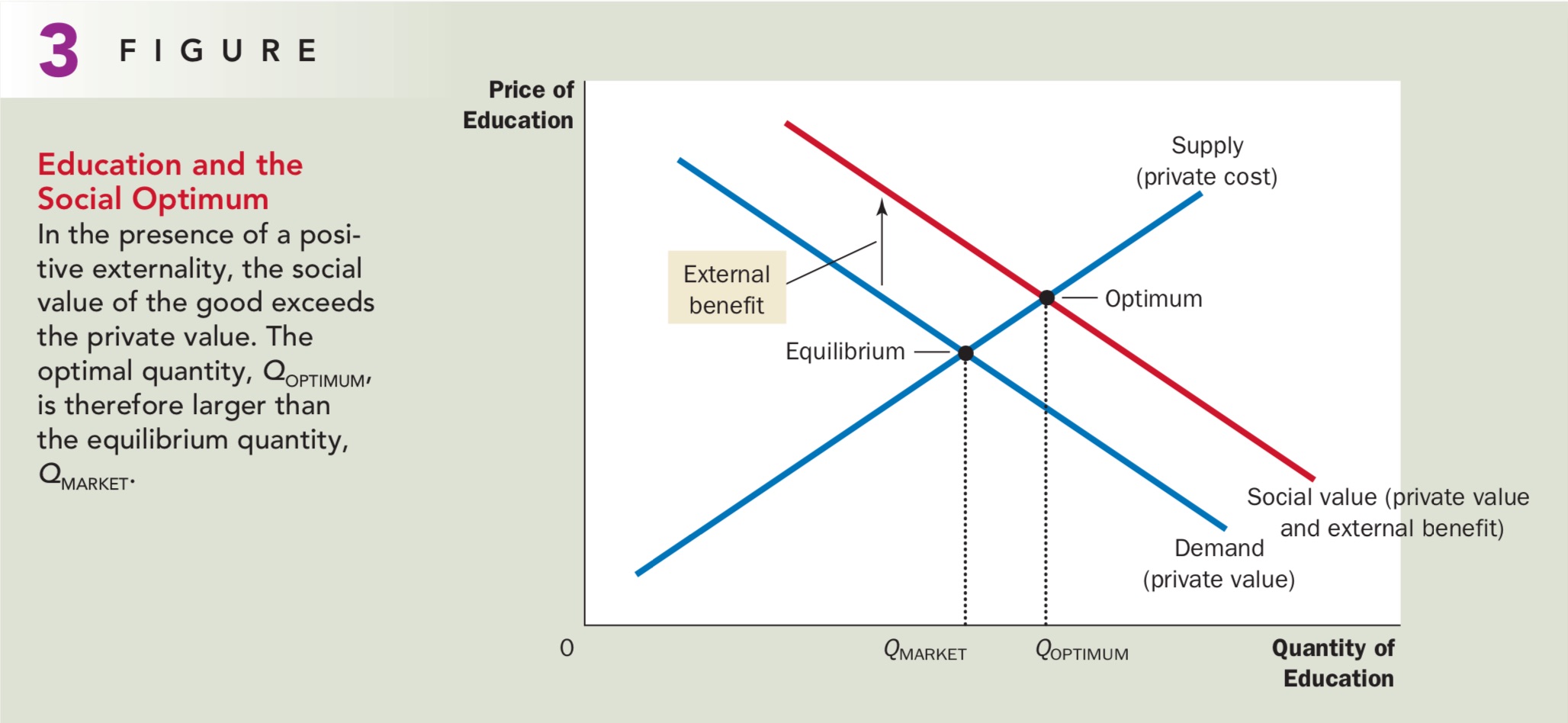

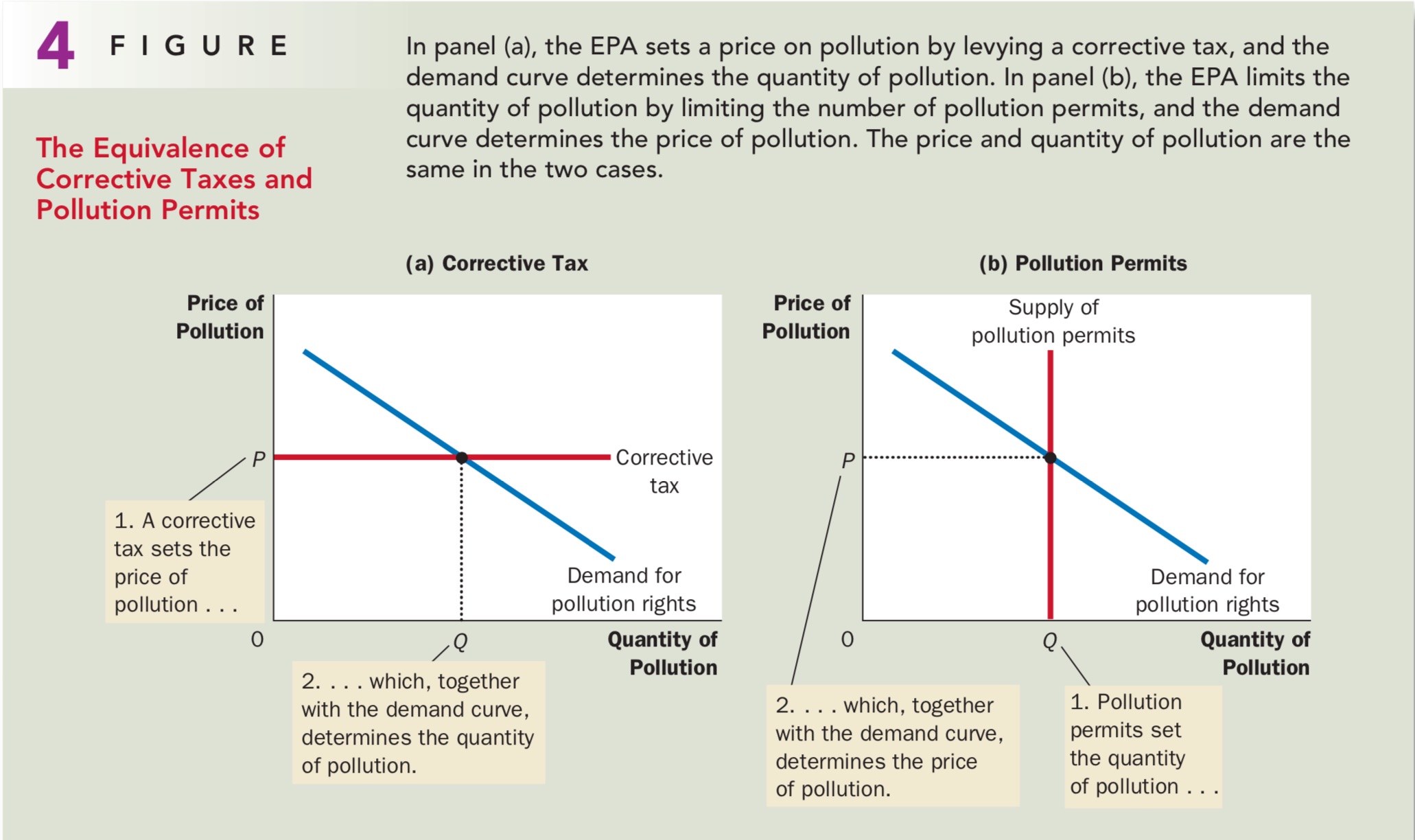

- (d) Assuming no externalities, how does the tax affect allocative efficiency? Explain

- Solution:

- Method 1: It produced deadweight loss.

- Method 2: The Consumer Surplus and Producer Surplus decreased.

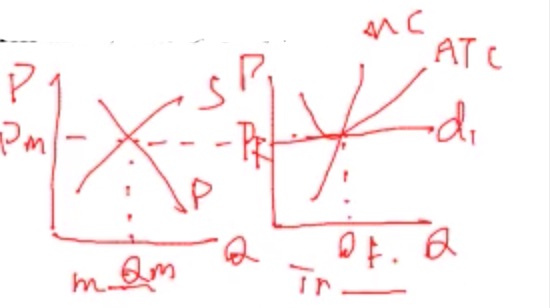

Unit 3 - FRQ - 1

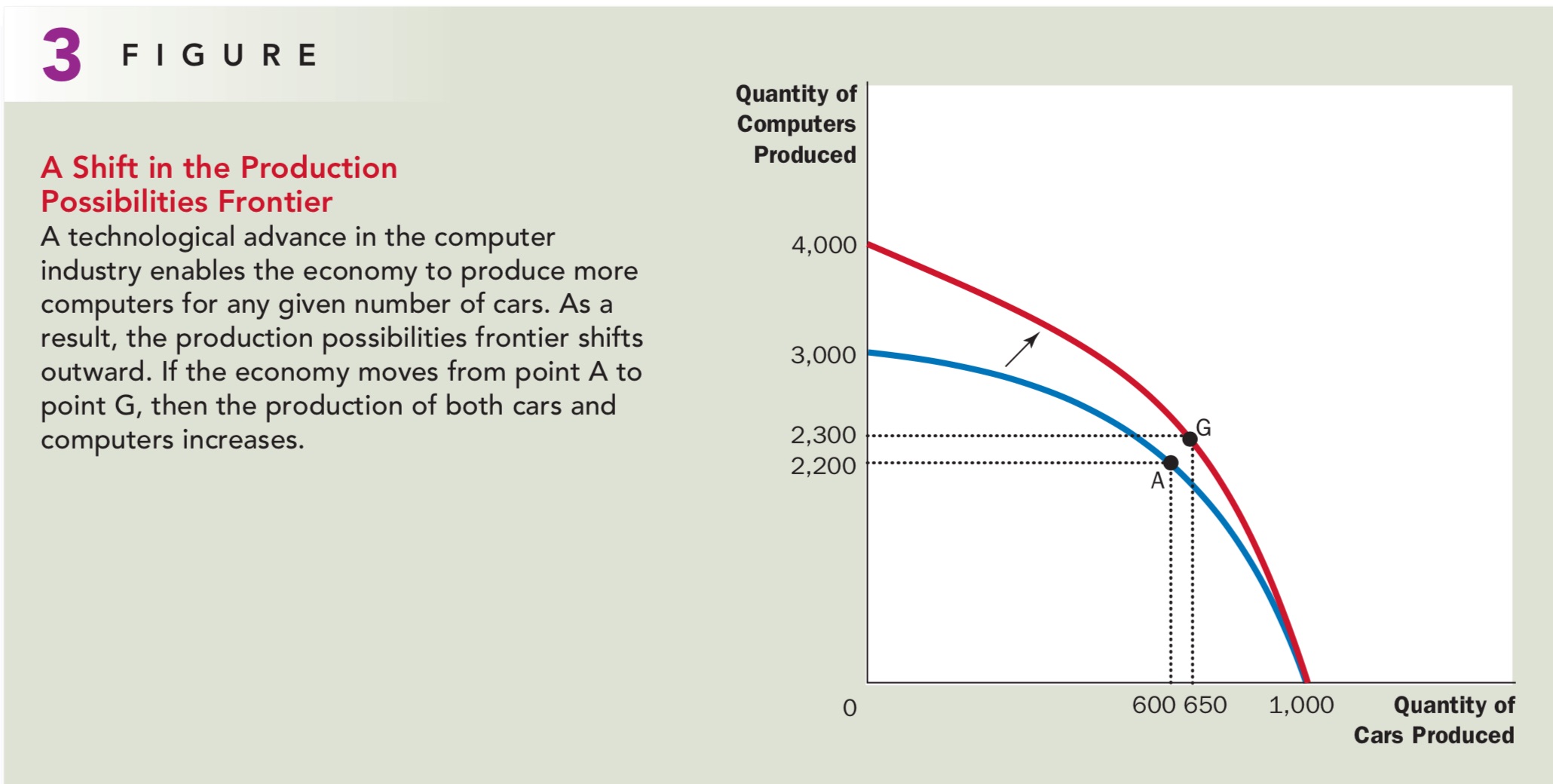

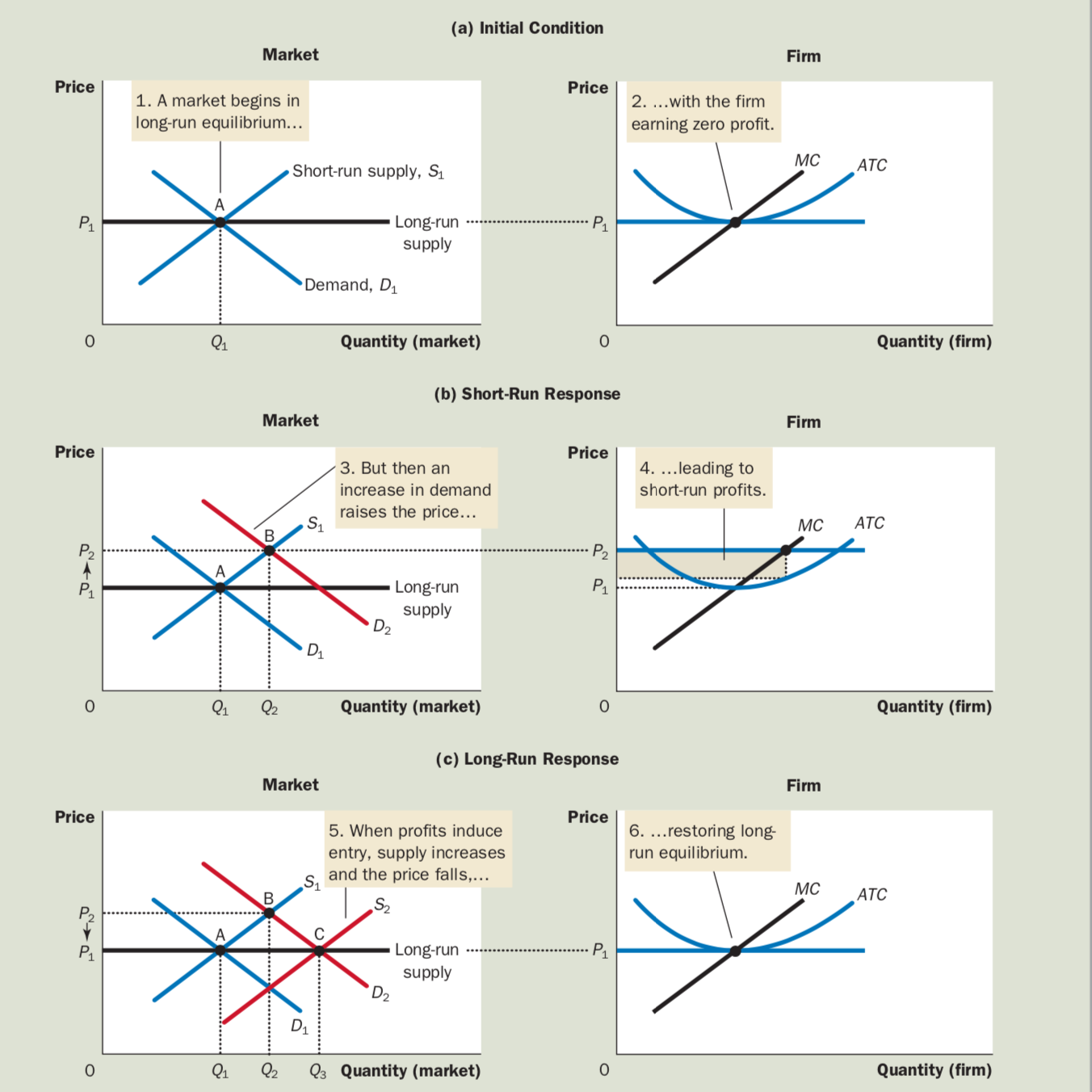

Suppose that roses are produced in a perfectly competitive, increasing-cost industry in long-run equilibrium with identical firms.

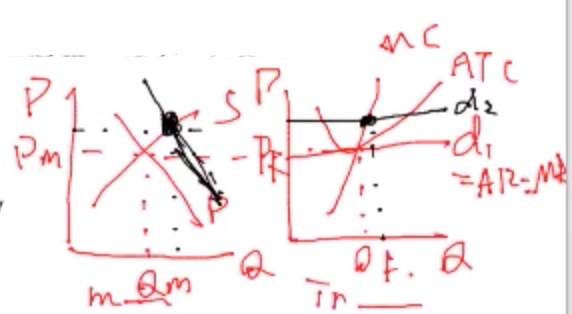

- (a) Draw correctly labeled side-by-side graphs for the rose industry and a typical firm and show each of the following

- (i) Industry equilibrium price and quantity, labeled $P_m$ and $Q_m$, respectively

- (ii) The firms equilibrium price and quantity, labeled $P_f$ and $Q_f$ respectively

- (b) Is $P_m$ larger than, smaller than, or equal to $P_f$?

- Solution: $P_m = P_f$

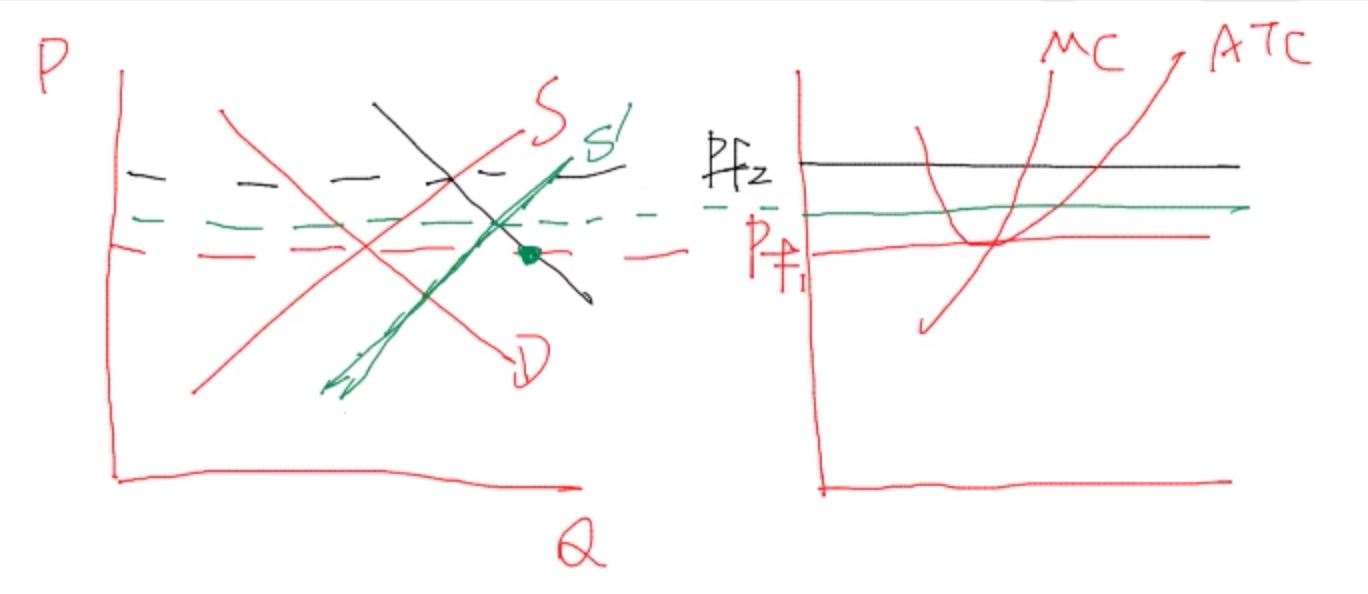

- (c) Assume that there is an increase in the demand for roses On your graphs in part(a), show each of the following.

- (i) The new short-run industry equilibrium price and quantity, labeled $P_{m2}$ and $Q_{m2}$, respectively

- (ii) The new short-run profit-maximizing price and quantity for the typical firm, labeled $P_{f2}$ and $Q_{f2}$, respectively

- (d) As the industry adjusts to a new long-run equilibrium,

- (i) what will happen to the number of firms in the industry? Explain

- Solution: The number of firms in the industry will increase. Since the profit $\pi = (P - ATC) \times Q > 0$, the existence profit attracts to enter the industry and there is no barrier of entering the market, there will be more firms in the industry.

- (ii) Will the firm’s average total cost curve shift upward, shift downward, or remain unchanged?

- Solution: It will shift upward for the reason that it is an Increasing-cost Industry.

- (e) In the long run, compare the firm’s profit-maximizing price to each of the following

- (i) $P_f$ in part(a)(ii)

- Solution: $P > P_f$, Higher

- (ii) $P_{f2}$ in part(c)(ii)

- Solution: $P < P_{f2}$, Lower

Unit 4 - FRQ - 1

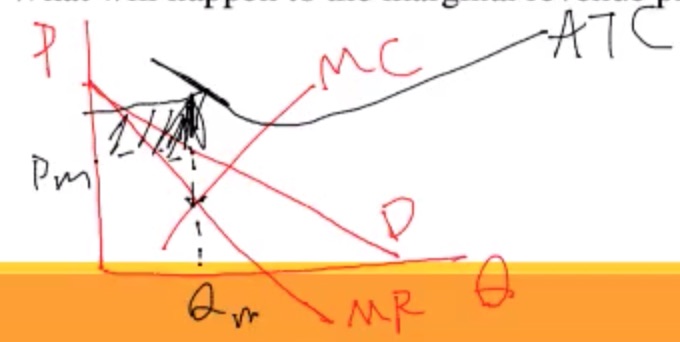

In the early twentieth century, limited transportation options and the lack of effective substitutes gave Single Cinema monopoly power in a small town. Assume that Single Cinema is a profit-maximizing firm and currently operates at a negative economic profit in the short run

- (a) Draw a correctly labeled graph for Single Cinema, and show each of the following

- (i) The profit-maximizing price and quantity of tickets, labeled as $P_m$ and $Q_m$, respectively

- (ii) The area representing the negative economic profit, shaded completely

- (b) Explain why Single Cinema continues to operate in the short run despite earning negative economic profit in the short run

- Solution: $P > AVC$

- (c)Would Single Cinema’s total revenue increase, decrease, or stay the same if it decides to sell one fewer ticket than $Q_m$? Explain.

- Solution:

- Method 1: $MR > 0$, $TR$ will decrease.

- Method 2: The demand curve is always elastic when $MR > 0$, thus total revenue will decrease when quantity decrease.

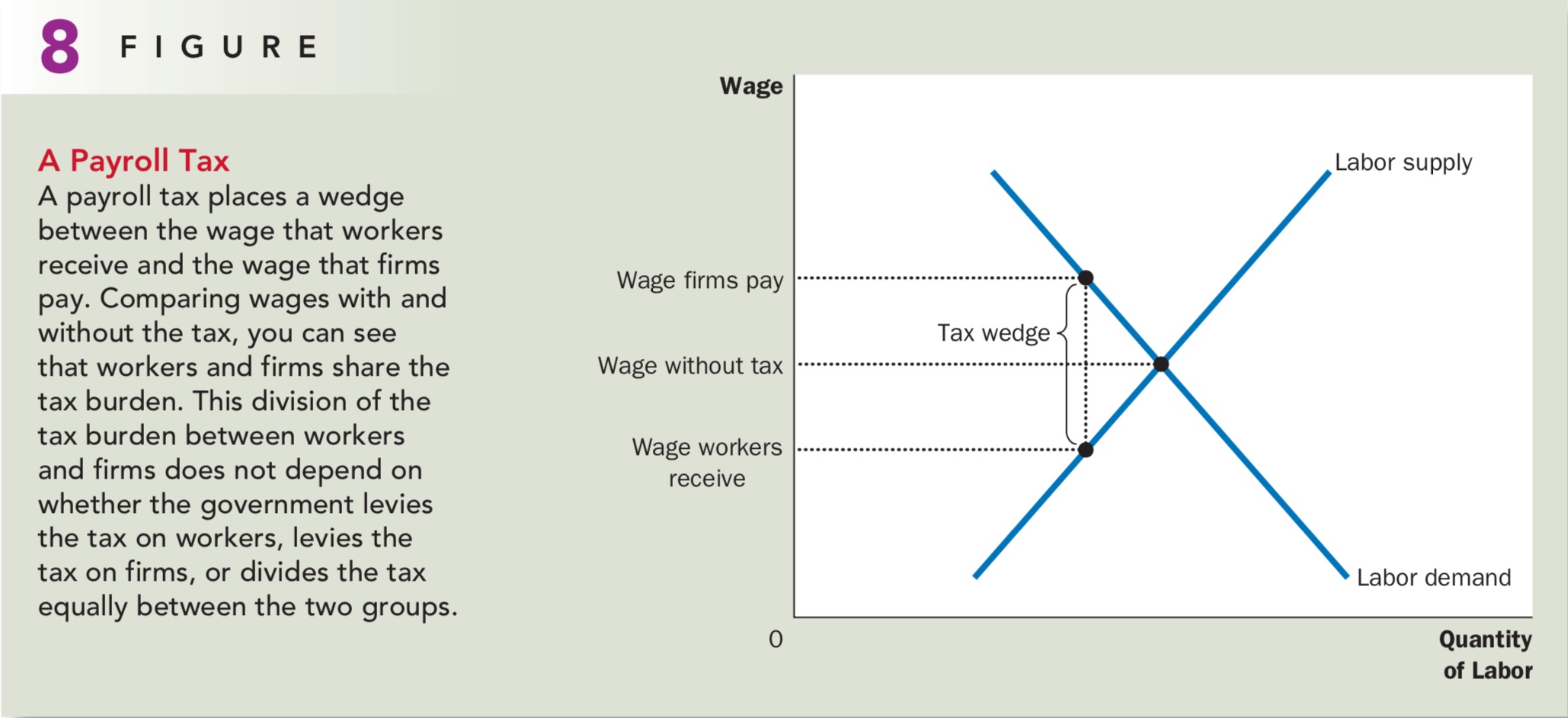

- (d) Single Cinema hires workers in a perfectly competitive labor market with a downward-sloping demand curve. Suppose the number of workers available in the market decreases

- (i) What will happen to the wage rate? Explain

- (ii) What will happen to the marginal revenue product of the last worker hired? Explain

Unit 4 - FRQ - 2

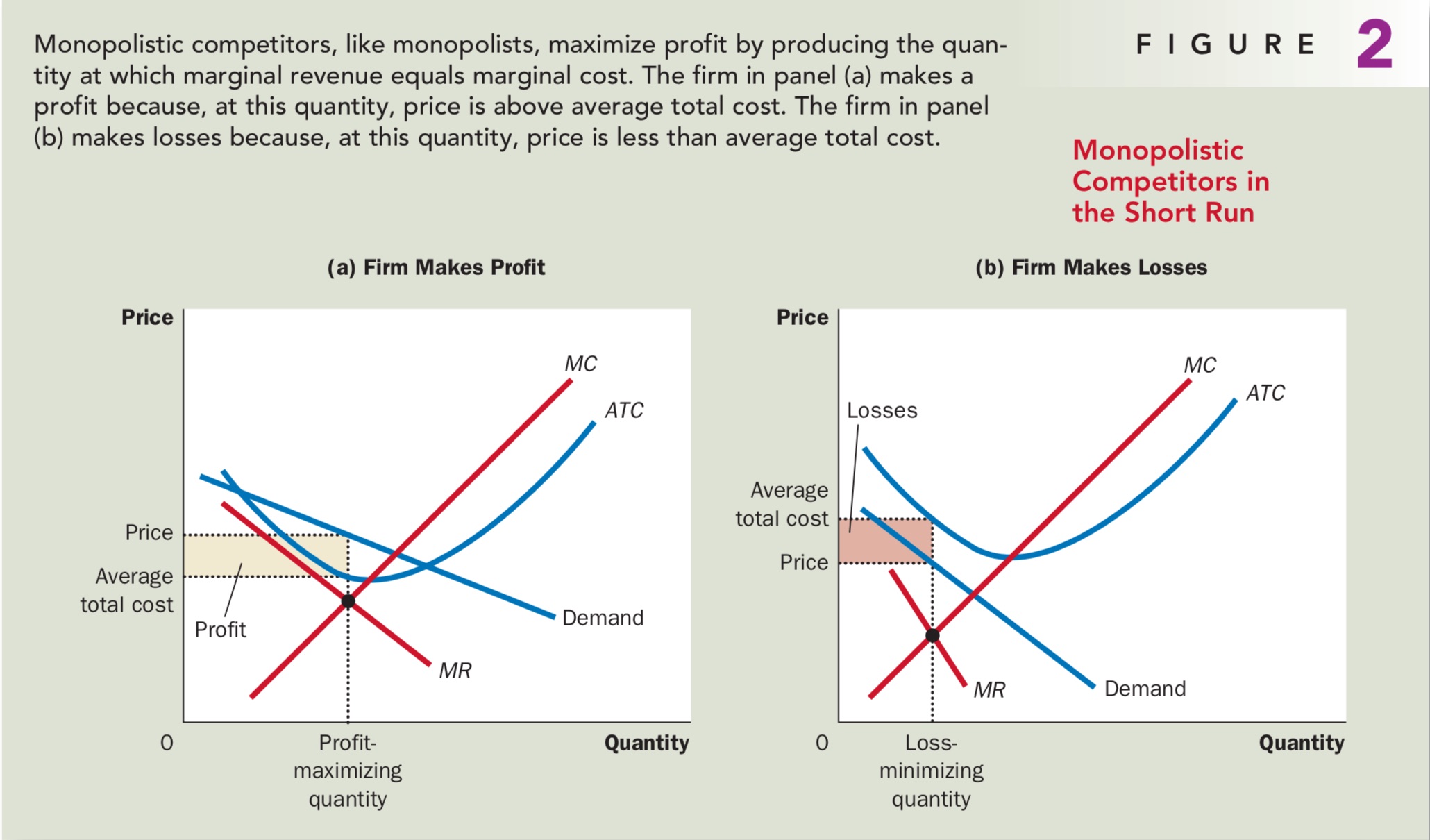

Mary Company, operating in a monopolistically competitive industry, produces a cleaning product called BriteKlean. The company currently produces the profit-maximizing quantity of BriteKlean but is operating at a loss.

- (a) Draw a correctly labeled graph for Mary Company and show each of the following

- (i) The profit-maximizing output and price, labeled as Q and PM, respectively

- (ii) The area of loss, shaded completely

- (b) what must be true in the short run for the company to continue to produce at a loss?

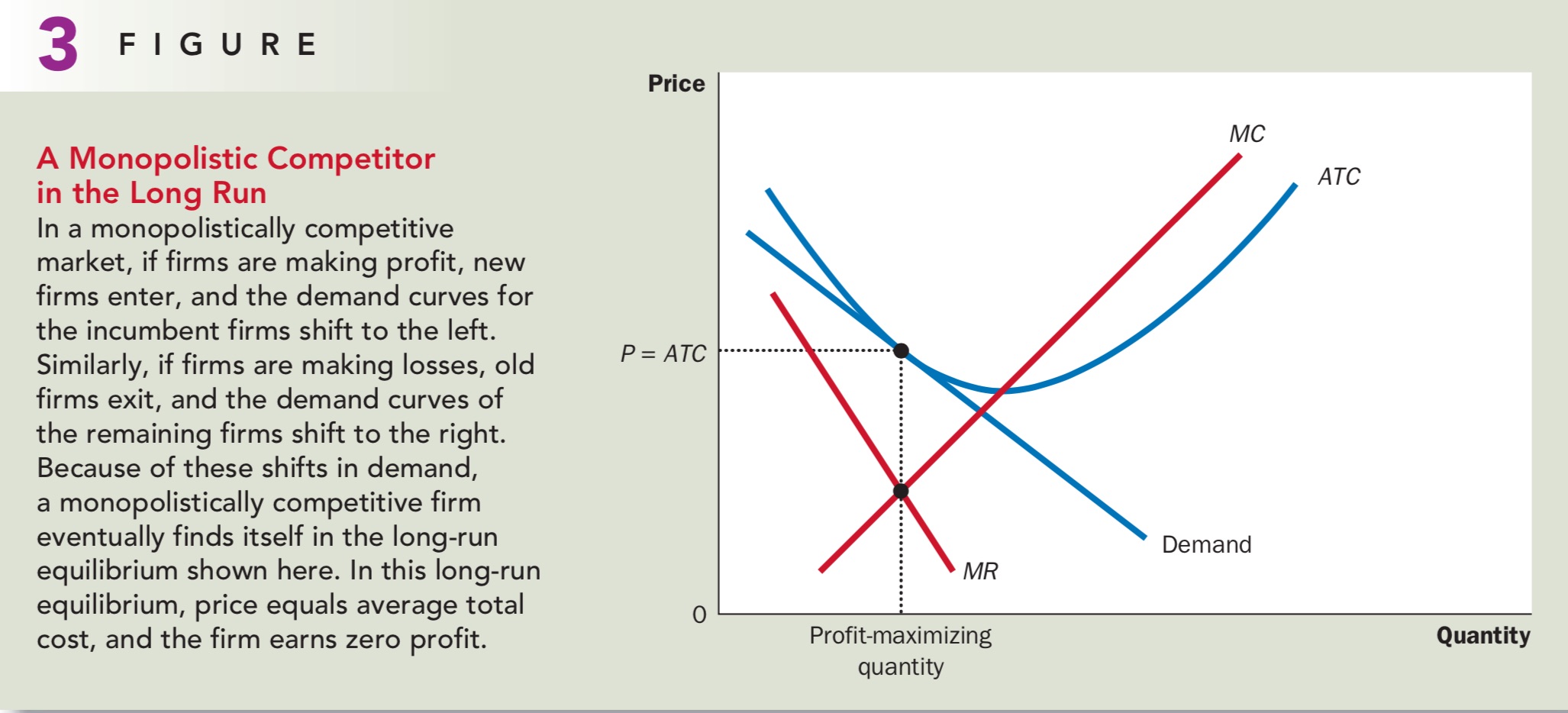

- (c) Assume now that the demand for cleaning products increases and that the company is now earning short-run economic profits. Relative to this short-run situation, how does each of the following change in the long run?

- (i) The number of firms

- (ii) The company’s profit

- (d) In the long run, if the company continues to produce, will it produce the allocatively efficient level of output? Explain

- (e)In the long run, will the company be operating in a region where economies of scale exist? Explain.

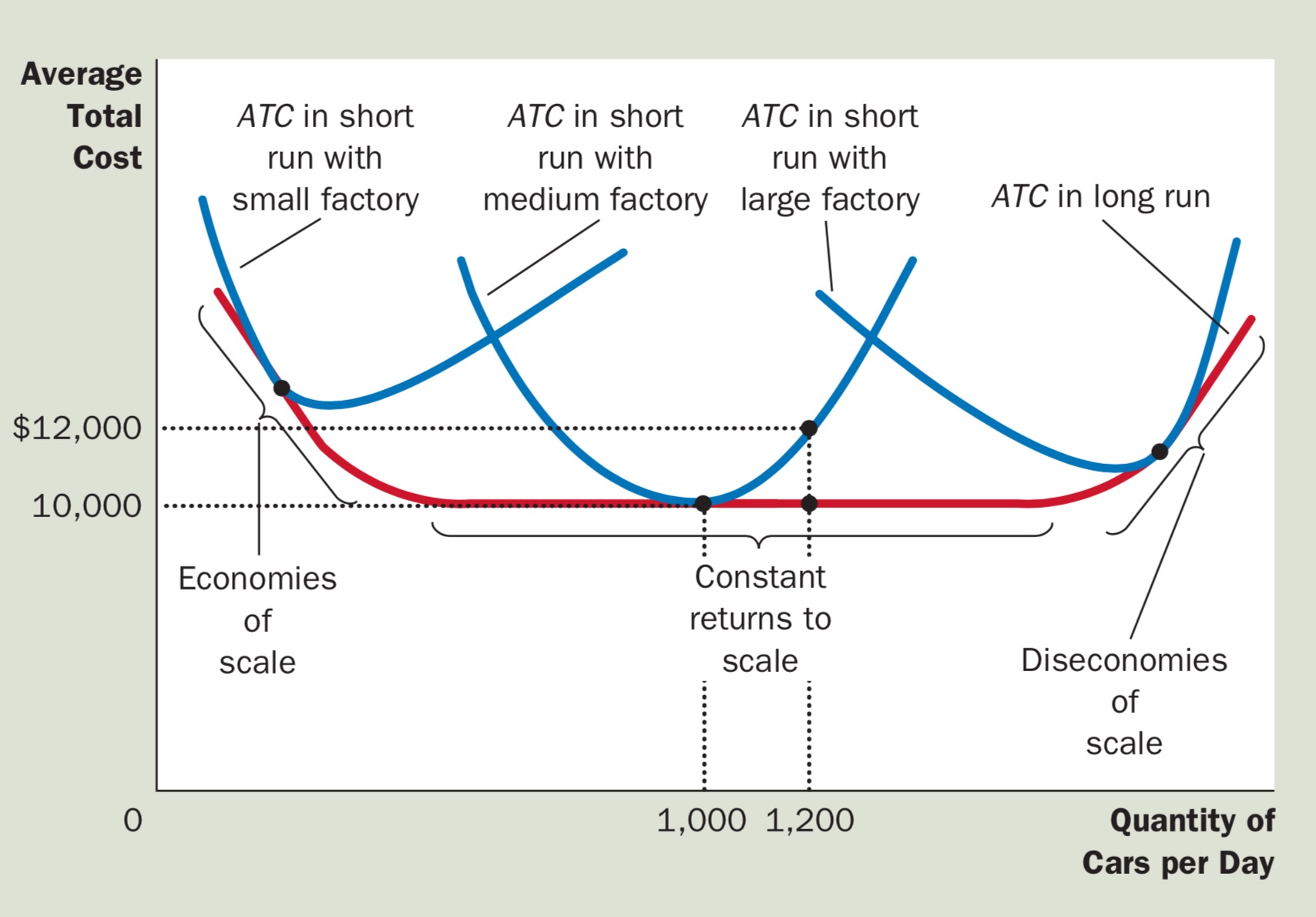

- Solution: It will operate in a region where economies of scale exist, because the firm is in a monopolistically competitive industry. In the long run, $P = ATC > \min ATC$, the firm will always produce where the slope of $ATC$ is negative, from which the company is operating in a region where economies of scale exist.

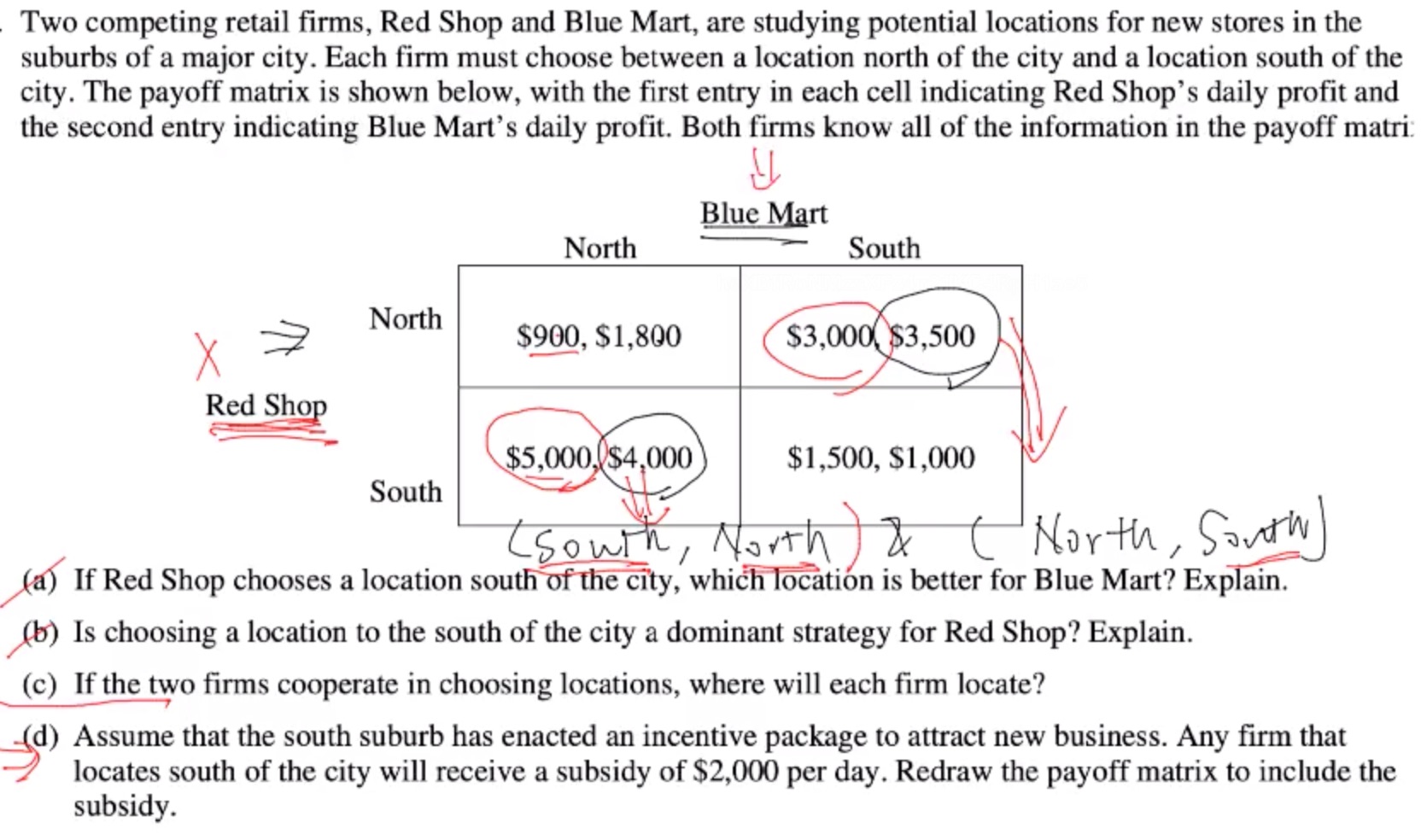

Unit 4 - FRQ - 3

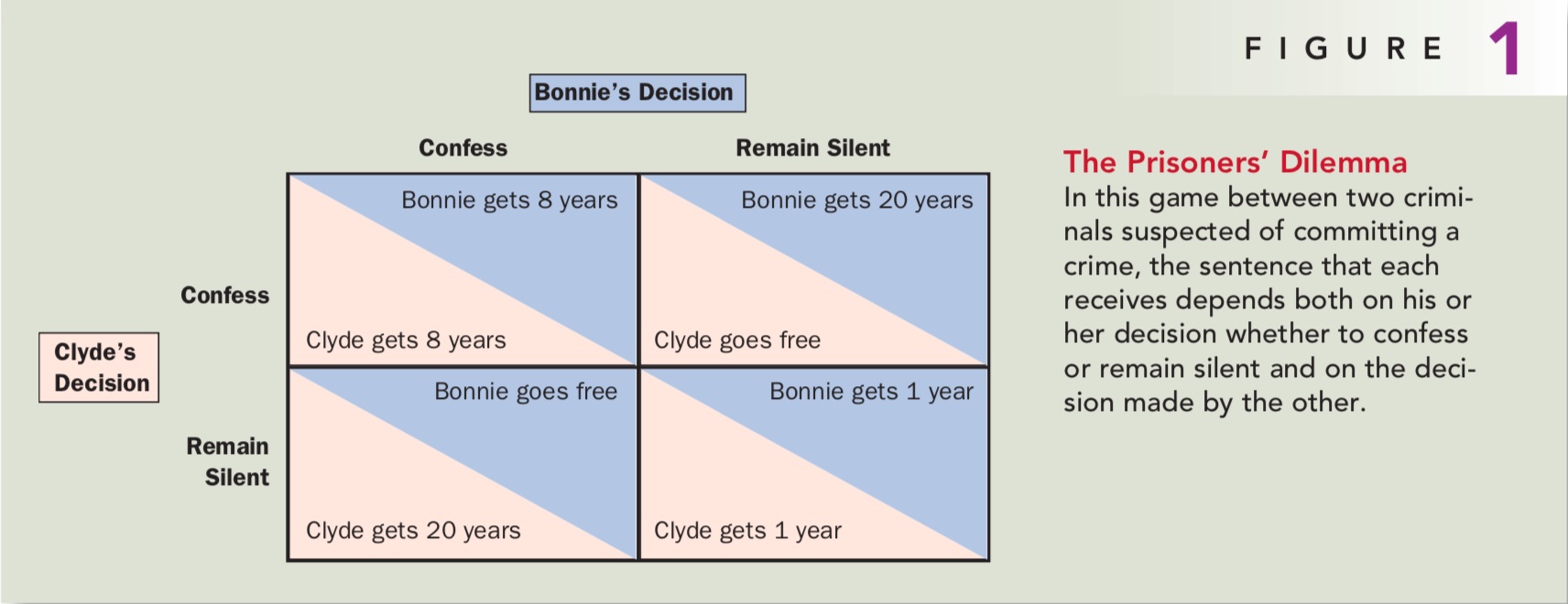

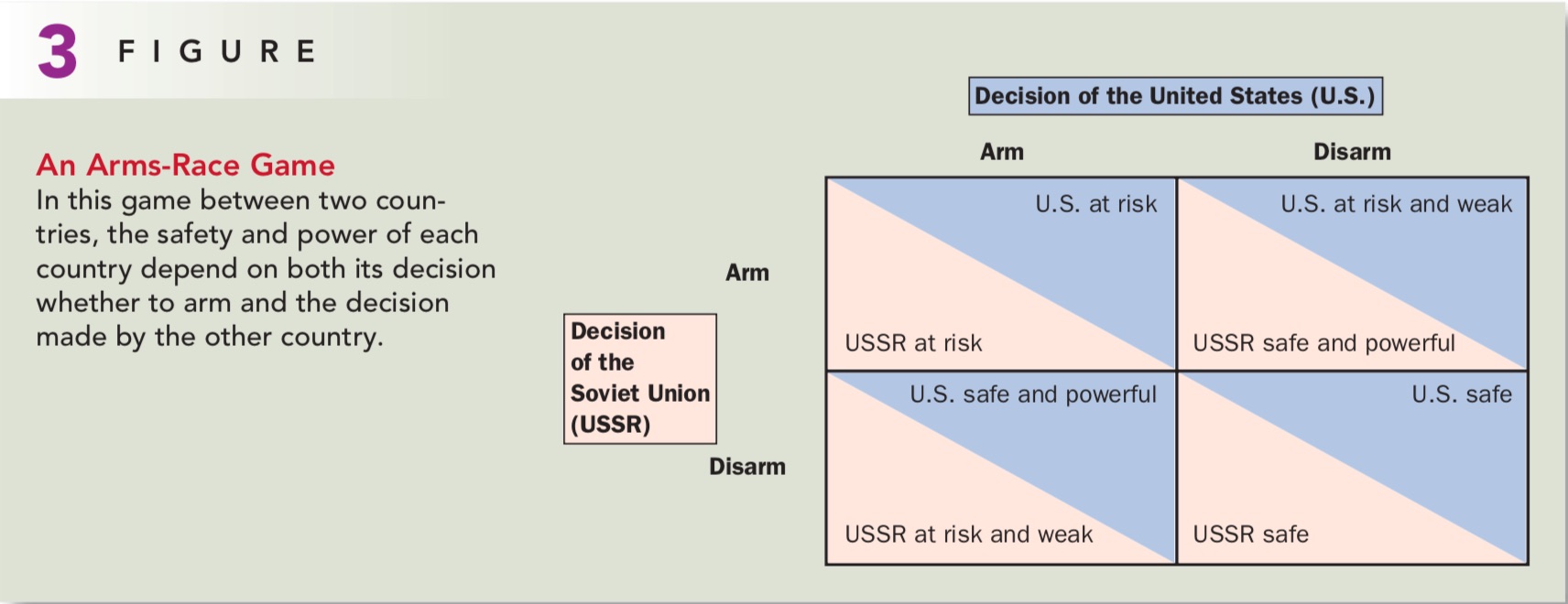

这一题当中,Nash Equilibrium有两个,已经在图片上标注出来了。做法:画圈圈出对手在不同情况下选择做出的Dominant Strategy或者Strategy,如果一个格子里有两个公司的圈就是均衡。

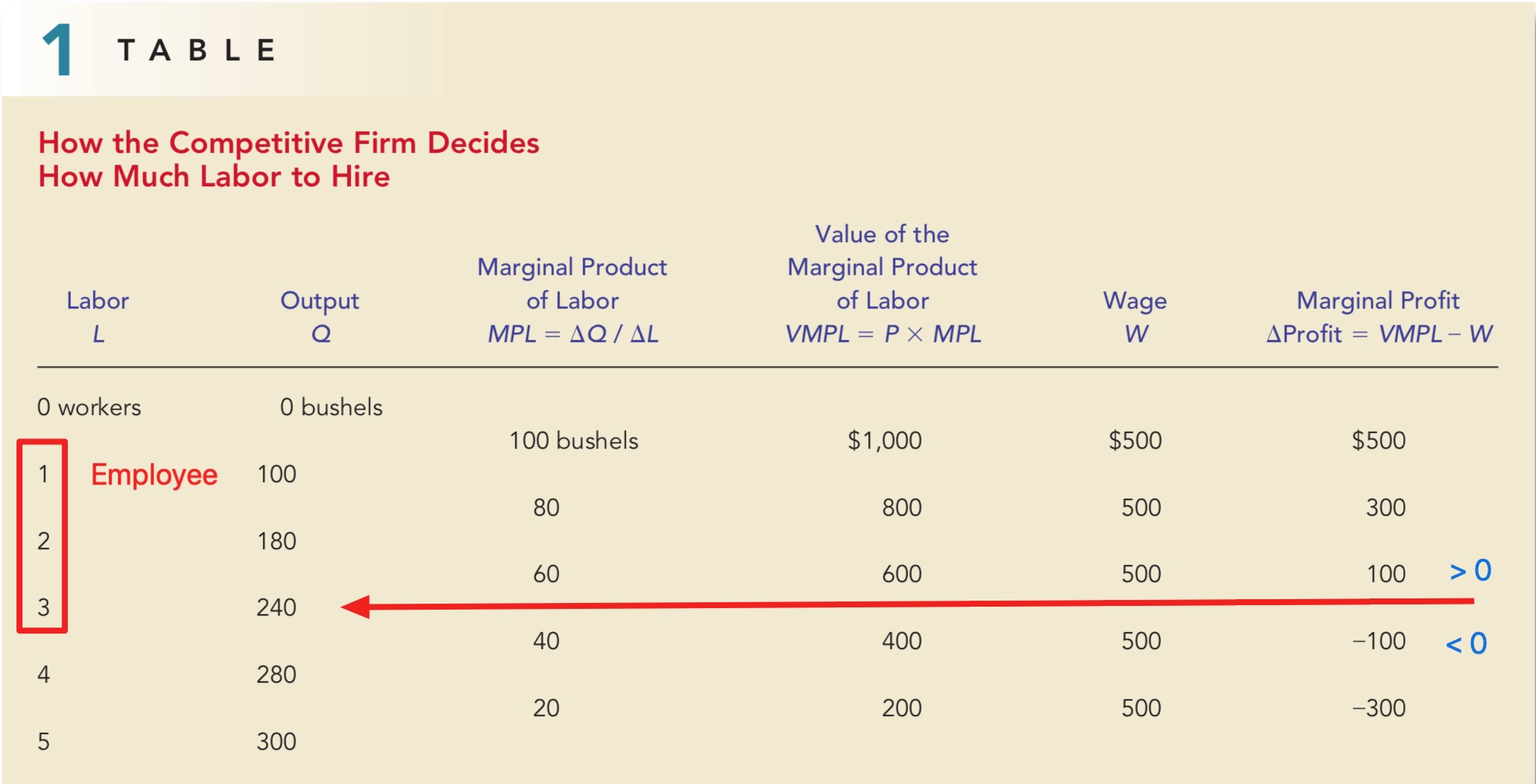

Unit 5 - FRQ - 1

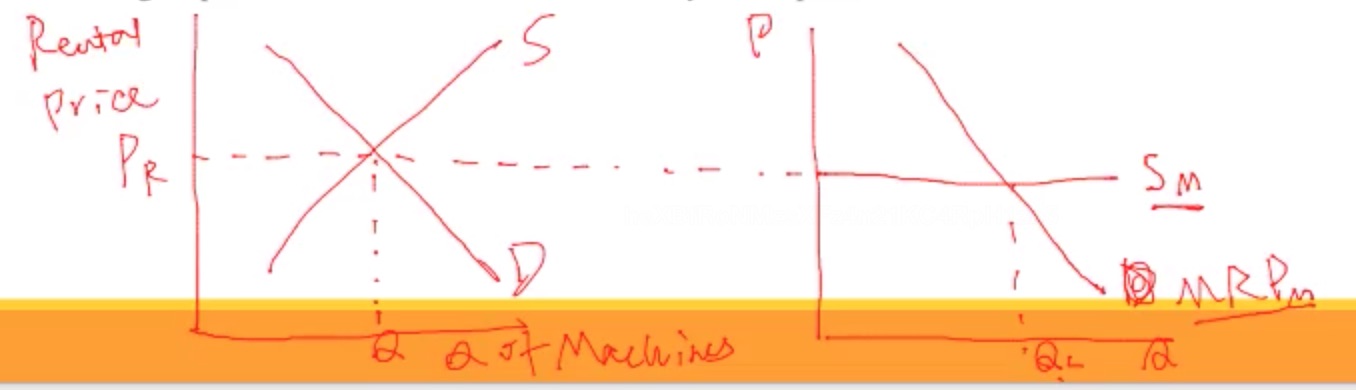

The John Lamb Company, a profit-maximizing firm producing widgets, is in a perfectly competitive widget market. Assume John Lamb employs a fixed number of employees and rents a machine for a variable number of hours from a perfectly competitive market

- (a) Using correctly labeled side-by-side graphs of the factor market for machines and the John Lamb Company, show each of the following

- (i) The equilibrium rental price of machines in the factor market, labeled as $P_R$

- (ii) John Lamb’s equilibrium rental quantity of machines, labeled as $Q_L$

- (b) Assume that the popularity of widgets declines, decreasing the demand for widgets. What will happen to each of the following?

- (i) Marginal product curve for machine-hours

- Solution: It will remain the same. $MP_M$ doesn’t relate with $P$

- (ii) Marginal revenue product curve for machine-hours. Explain.

- Solution: It will decrease, since $MR = P \times MP_M$, with $P$ decreasing, $MR$ will decrease too.

- (c) John Lamb is employing the cost-minimizing combination of inputs. The marginal product of labor is 28 widgets per worker hour and the wage rate is $14 per hour. The marginal product of the machine is 60 widgets per machine-hour. What is the hourly rental price of a machine?

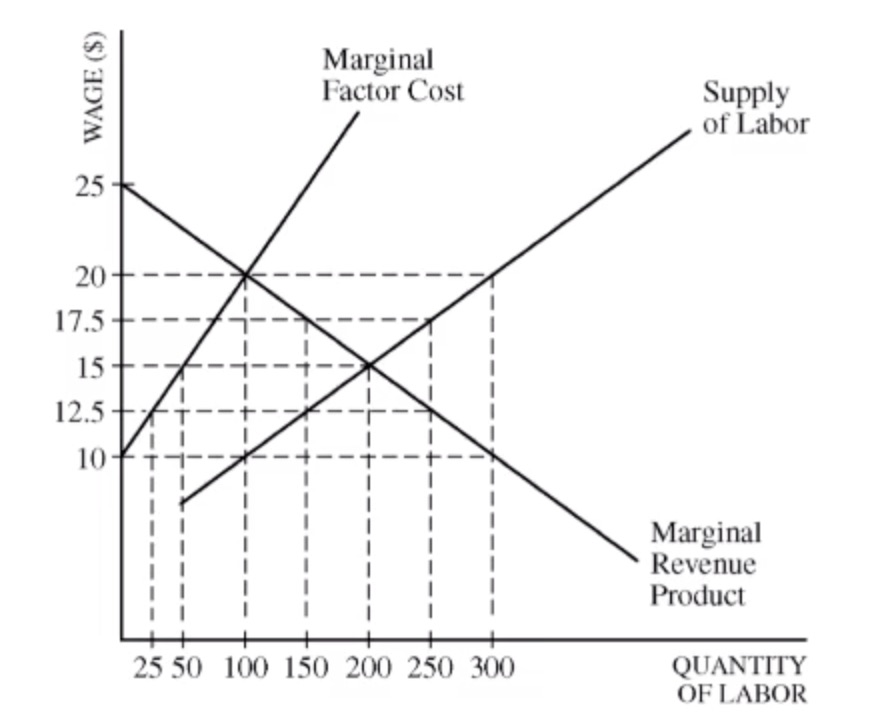

Unit 5 - FRQ - 2 - Monopsony(单一Employer)

Woodland is a small town in which everyone works for TreeMart, the local lumber company. TreeMart is a monopsonist in the labor market and a perfect competitor in the lumber market. In the short run, labor is the only variable input. The labor market for TreeMart is given in the graph above

- (a) Identify the profit-maximizing quantity of labor for TreeMart

- Solution: $MC = MR$, 100.

- (b)Identify the wage rate Tree Mart pays to hire the profit-maximizing quantity of labor

- Solution: $10

- (c) Identify the quantity of labor hired in each of the following situations.

- (i) Tree Mart operates in a competitive labor market

- Solution: Competitive $\rightarrow S = D$, 200.

- (ii) The government imposes a minimum wage of $12.5 Explain.

- Solution: With the minimum wage of $12.5, according to the supply curve of labor, the company will hire 150 units of labor.

重要注意点

- 写清楚单位